On-Demand analysis for private equity firms to rapidly evaluate investment opportunities pre-deal, and inform strategic operating decisions post-deal.

Private Equity & Data Science

We combine private equity industry experience with data science expertise to enhance investment decision-making, enabling data-driven insights both pre and post deal across a wide variety of industries.

Private Equity Analytics

- Understanding of industry structures with a special focus on financial services, retail and consumer, media and telecom, and technology

- Assist deal team and operating groups with predictive analytical models and implementation

- Predictive analytical tools include revenue forecasting, price elasticity, customer segmentation and channel analysis, customer churn, and survey analysis

Data Science

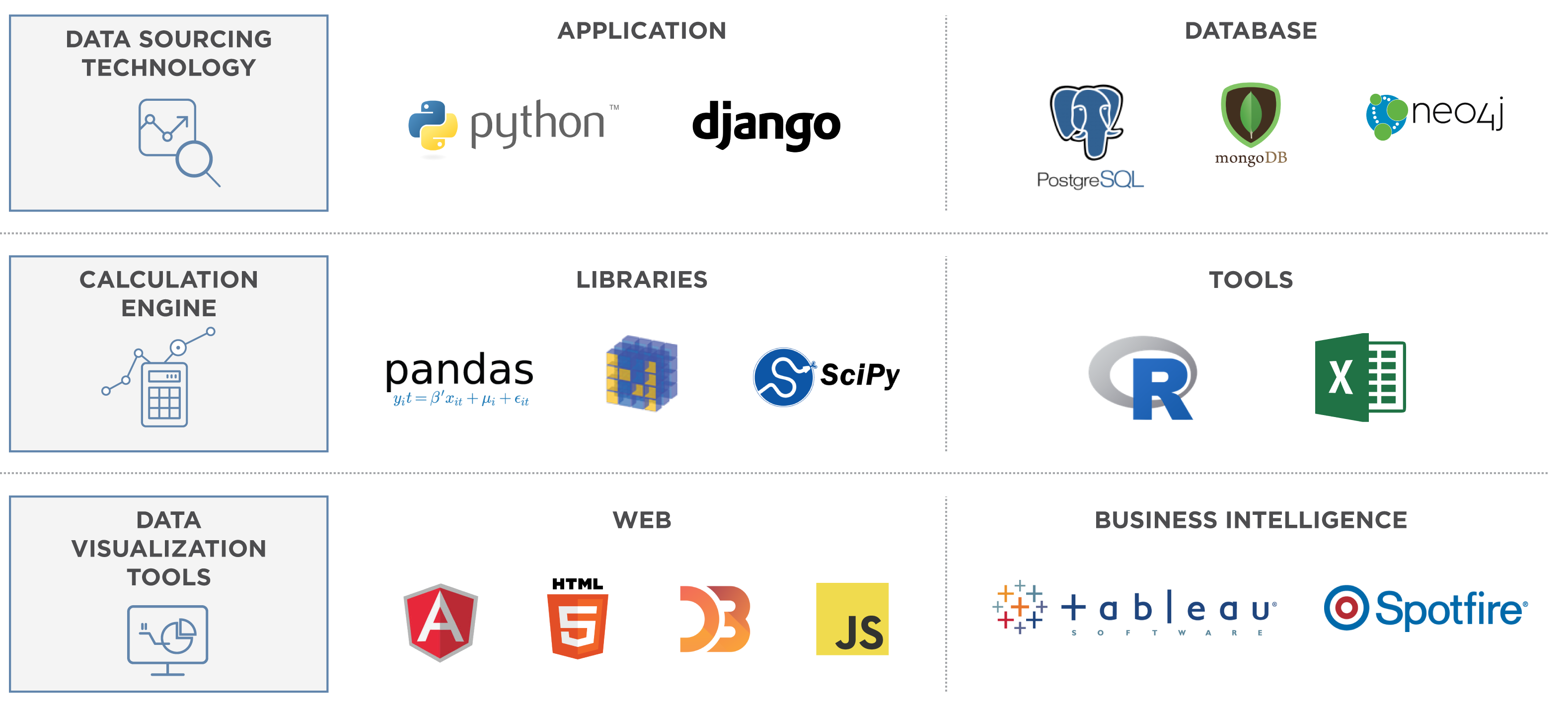

- Sophisticated data sourcing technologies seamlessly integrate data across multiple sources and formats

- Automatically gather information from portfolio company systems, proprietary research, industry news, and regulatory filings.

- Calculation engines to rapidly model cases and run scenarios

- Data visualization tools extract insights from data and generate new ideas, providing key analytics at-a-glance

Key Benefits

SPEED

Analyze Data and Test Hypothesis Quickly

Actionable analytics that become an integral part of the decision-making process enabling teams to analyze opportunities and isolate risks quickly.

INCORPORATE MORE SOURCES

INCORPORATE MORE SOURCES

Leverage Traditional Financial Data and New Sources of Unstructured Information

Include new criteria and metrics in investment decisions derived from sources such as internal company systems, news feeds, regulatory filings, and research reports.

VOLUME

Incorporate Large Volume of Data into Financial Models

Allow for the use of big data sets in financial analysis such as geolocation, website user tracking, and mortgage loan level data.

VISUALIZATION

VISUALIZATION

Visual and Interactive Analytic Tools to Uncover Trends Hidden in Disconnected Data

Empower analysts to understand and derive insights from disparate data sets using visual interactive tools, charts, and graphs.

DECISION MAKING

Decision Making Framework with Predictive Tools

Create data-driven systematic decision dashboards that leverage predictive analytical tools and utilize information from disparate sources and systems.

Our Tools and Platform

LIBRARY OF TOOLS

- Structure unstuctured sources-PDFs, Excel, web

- Natural language processing (NLP) to identify key themes in research documents, news feeds etc

- Sentiment analysis to identify and score views

- Interactive customizable dashboards

- Produce charts and infographics

- Integrate with analytic tools such as Tableau, Excel, MATLAB, R etc.

- Regression, correlation, variance, covariance models

- Time-series forecasting and trend estimation

- Principal component analysis and other statistical decomposition techniques

- Assistance with portfolio company valuation

- Return-risk optimization frameworks that incorporate predictive market simulation

- Price elasticity and consumer behavior models with scenario analysis and stress testing

INVESTMENT ANALYTICS PLATFORM – RADiENT

- Market data time series tracking and forecasting

- Scenario analysis and stress testing

- Portfolio modeling and optimization

Case Studies

CASE CLIENT

![]() Portfolio Company: Luxury Fashion Brand Major PE firm $20B in AUM

Portfolio Company: Luxury Fashion Brand Major PE firm $20B in AUM

![]() Pricing Competitor Response Simulator Major PE firm $20B in AUM

Pricing Competitor Response Simulator Major PE firm $20B in AUM

![]() Customer Churn Analysis Global Payment Processing Solutions Provider

Customer Churn Analysis Global Payment Processing Solutions Provider

Key Technologies