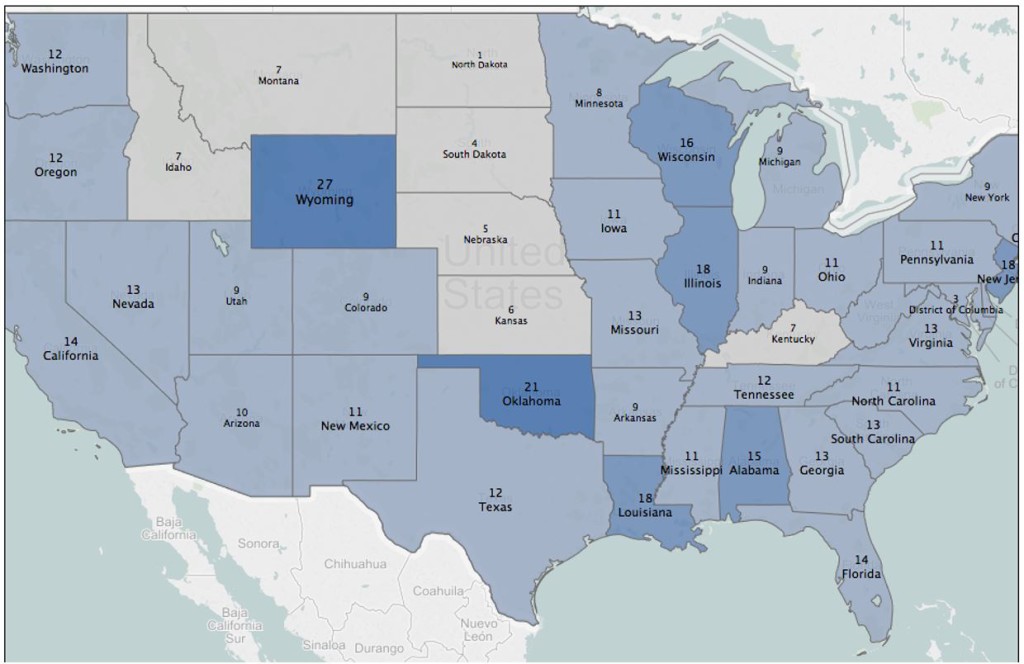

Average Life Broken Down by Geography

Average Life Broken Down by Geography

Case Study

Analyze and value a portfolio of insurance settlements with variable cash flows and attached optionality, for the structured settlements investments team at a hedge fund. Our client was evaluating whether to acquire the portfolio and analyzing the potential payouts.

Solution:

- Combine data from the insurance servicer with both internal proprietary research and demographic information in the public domain

- Determine future cash flows with associated probabilities, and identify all attached optionality and calculate option values

- Visualize drivers of value through traditional charts and new data visualization techniques

Benefits:

- Provide transparency into the underlying settlement and the ability to independently value the portfolio

- Quickly test scenarios by changing assumptions, parameters, and data sets

- Online tools enabled the hedge fund to both use the analytics internally and easily collaborate with partners and investors

→ Related Service Offering: Financial Analytics as a Service