Hedge Fund Analysis and Research

Identify and evaluate investment opportunities with fund managers in key markets.

We provide professional investors with analysis and research on fund managers through applying our investment analysis and risk management framework. The goal is to provide institutional investors with high quality quantitative analysis supported by a qualitative review to help them meet their risk-return parameters and address diversification objectives. In developed markets, we focus on institutional quality asset managers to evaluate their investment thesis and their operations. In key emerging markets, we develop in-country research and apply our rigorous risk-based analytical approach to identify and track the best managers.

We offer:

- Manager Selection – Identify and analyze hedge fund managers through in-depth research and applying a quantitative and qualitative framework

- Ongoing Monitoring – Monitor through periodic manager visits and ongoing tracking of fund newsletters and materials

- Investment Analytics – Quantitative and qualitative metrics with portfolio construction capabilities delivered through RADiENT

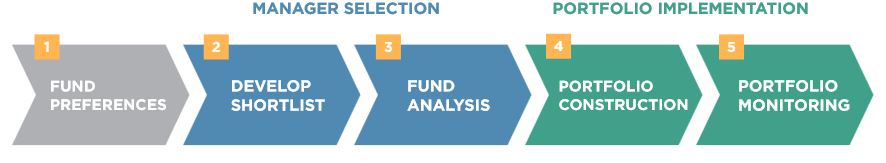

Our Approach

Our approach combines a risk-based research process enriched with markets expertise to create a selection of hedge funds for the client’s review. We evaluate each fund on a rigorous set of qualitative and quantitative criteria which are tailored to meet the specific objectives of the client. We select the investment teams that have successful track records, defined investment processes, a well-developed operating platform and a disciplined, comprehensive risk management culture. The selected hedge funds typically have over $150 million in assets under management with over a two-year track record and have passed the stringent due diligence review of institutional investors such as pension funds and endowments. Finally, we assist with the portfolio construction process across selected hedge funds and public funds, and provide monthly performance updates and analysis.

RADiENT Investment Analytics

Critical to this process is our industry leading online RADiENT Investment Analytics system. RADiENT allows us to analyze a broad range of funds and portfolios that include hedge funds, mutual funds, and ETFs, and share our results through online interactive dashboards. Driven by data science, RADiENT enables us to analyze individual funds, run comparative analyses, and construct potential portfolios of investments to determine which funds and combination of funds best meet the objectives of the client. Armed with our quantitative conclusions and our qualitative review, we share a detailed evaluation of each fund and the proposed portfolio with our client.

Key Aspects

- Analysis – Risk based quantitative analysis developed through experience with leading institutional investors and RADiENT, our industry leading tool

- Market Research – In-depth research of the industry, economic conditions, market dynamics, and regulatory environment

- Manager Meetings – Produced through long-standing relationships, local partnerships, and regular visits

Key Markets

Our focus is on hedge fund managers in the United States and Western Europe. In addition, we have some specific areas of expertise in key emerging markets.

Investing in Brazil

Investing with Brazilian hedge funds and private equity managers can be a daunting task for foreign institutional investors. We provide data, analytics, local expertise and logistical support to clients interested in gaining an understanding of the Brazilian alternative investment management industry.

Investors from Brazil

We assist professional Brazilian investors seeking to add international diversification to their portfolios. We share our research, expertise, and knowledge of the offshore international hedge fund market.

India’s AIF – a Structure for Hedge Fund and Private Equity

We are monitoring the emergence of Alternative Investment Fund (AIFs) in India. While hedge funds and private equity funds have operated in India for sometime under a confusing set of rules and regulations, these legacy fund structures are gradually being phased out and replaced by new rules and regulations governing AIFs. With our presence in Mumbai, we are actively gathering data on the developing AIF market in India.