Performance Attribution

Performance Attribution

Case Study

A large institutional hedge fund investor required an easy to use research tool to provide risk analysis as well as access to fund documents and regulatory filing data to codify their fund selection process which is currently done using individual excel analysis and documents stored in different locations.

Solution:

- Apply data science to integrate unstructured data from fund documents with market data from various sources

- Develop a dashboard to calculate key fund metrics and access fund documents as a centralized tool for fund evaluation and selection

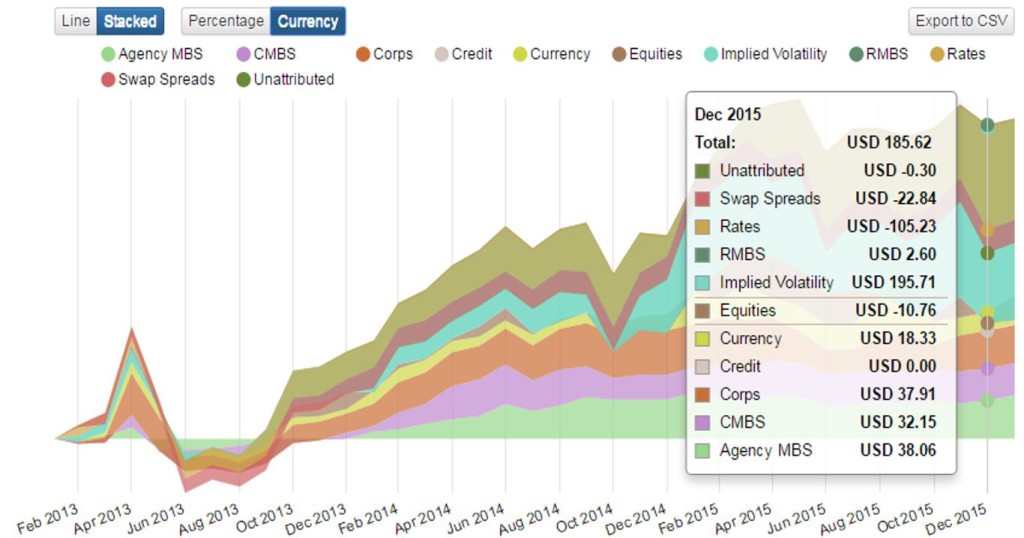

- Apply visualization tools to compare funds against market benchmark indices, performance attribution, and investment style analysis

Benefits:

- Provide analysts access to fund performance and risk metrics as well as fund documents including Fact Sheets, DDQs, and regulatory filings such as Form 13F from a single platform

- Enable hedge fund analysts to focus on the fund selection process instead of on statistical calculations, data sourcing, and document management

→ Related Service Offering: Financial Analytics as a Service