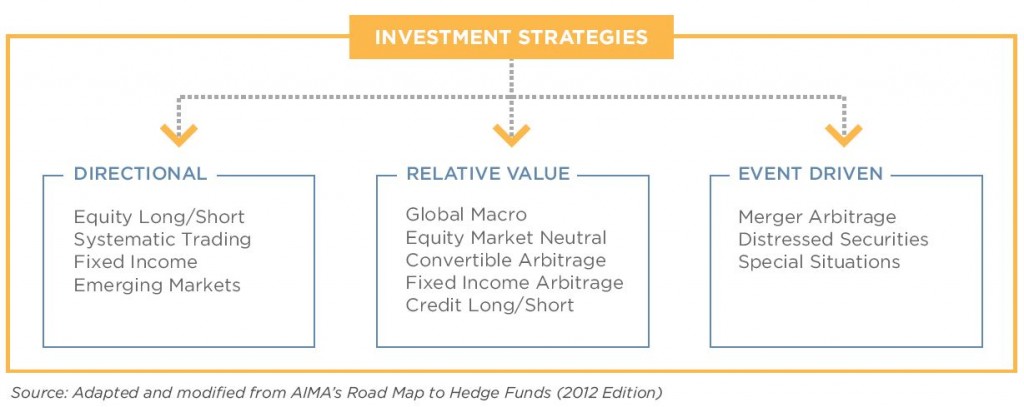

Managing market risk at a firm that trades across investment strategies and asset classes presents several challenges. Each investment strategy has specific market risk management nuances and combines securities and contracts of different asset classes. Further, each asset class has distinct exposures and risk metrics which make it difficult to apply a uniform set of measures across the portfolio. Lastly, managing risk at the firm level requires consolidating risks across investment strategies through appropriate summary risk measures.

We offer:

- Market Risk Measures – Determine market risk measures for specific asset classes and select appropriate metrics to summarize exposures at the portfolio and at the firm level

- Risk Limits and Procedures – Framework to define risk limits and develop policies and procedures to ensure portfolios remain within these parameters

- Valuation – Apply and back test valuation models for derivative contracts

- Modeling – Create risk models, scenario analysis, stress testing, proprietary risk analytics, and quantitative strategies

- Market Risk Technology – Recommend technology solutions and appropriate architecture for timely management of market risk

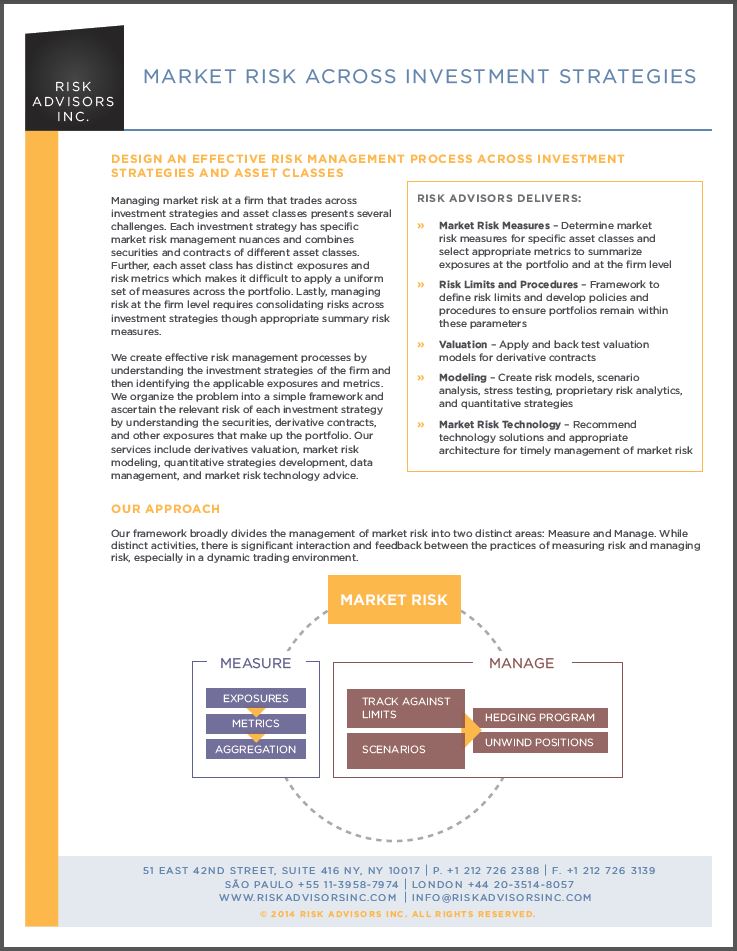

Our Approach

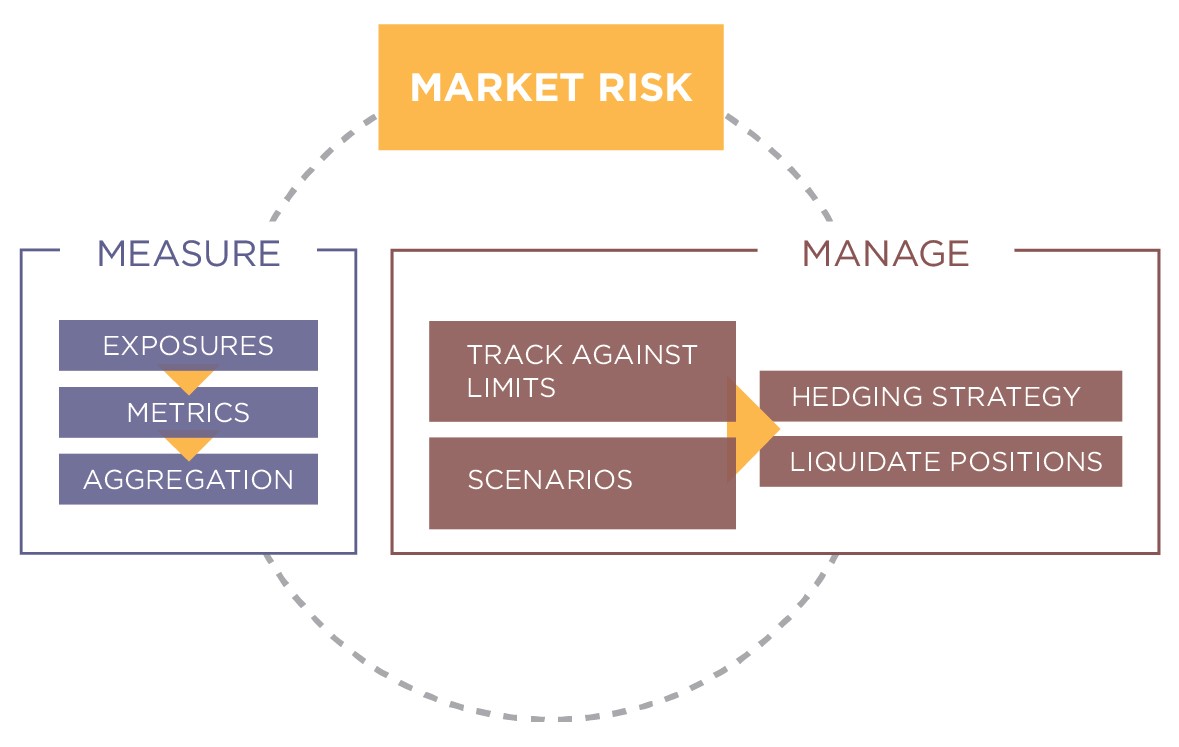

Our framework broadly divides the management of market risk into two distinct areas: Measure and Manage. While distinct activities, there is significant interaction and feedback between the practices of measuring risk and managing risk, especially in a dynamic trading environment.

Developing a Market Risk Management Process

We create effective risk management processes by understanding the investment strategies of the firm and then identifying the applicable exposures and metrics. We organize the problem into a simple framework and ascertain the relevant risk of each investment strategy by understanding the securities, derivative contracts, and other exposures that make up the portfolio. Our services include derivatives valuation, market risk modeling, quantitative strategies development, data management, and market risk technology advice.

The first step to developing a cohesive and robust market risk process is to understand the firm’s investment strategies along with the expected return profile, market drivers and risk factors.

Typically, a firm will have separate processes for the production of risk exposures and metrics by asset class. For example, disparate processes and systems exist for Equities investments versus Fixed Income activity. However, managing market risk cohesively requires consolidating exposures and metrics across portfolios and asset classes.

Applying Market Risk to Related Areas

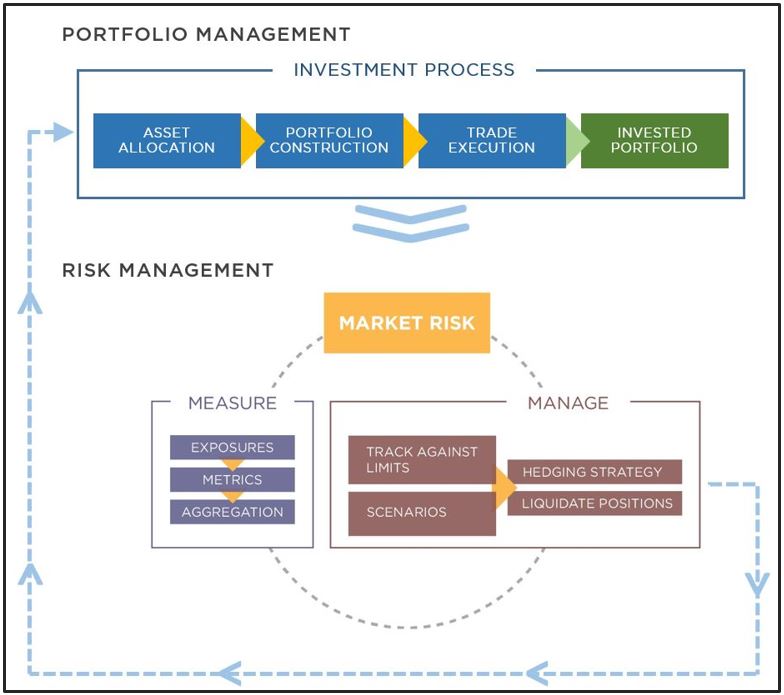

Investment Management

We collaboratively work with investment firms to apply risk frameworks that utilize technology to optimize the investment decision-making process. We assist in developing methods across the different aspects of an investment process namely asset allocation, portfolio construction, and trade execution. The goal is to enable our clients to implement their investment ideas, while creating a process that produces the best possible consistent risk-adjusted returns.

Regulatory Reporting

We enable our hedge fund clients to develop the operational capabilities to consistently manage their regulatory filings. We collaborate with our hedge fund clients to create both form preparation processes and technology systems, including identifying the different sources to collect the data from, classifying and mapping the data types into the required reporting categories, aggregating the data based on asset types as required by the regulator, and documenting the assumptions made as a guideline for future filings. Our expertise includes SEC’s Form PF, CFTC’s Form CPO-PQR, and the EU’s AIFMD filings.

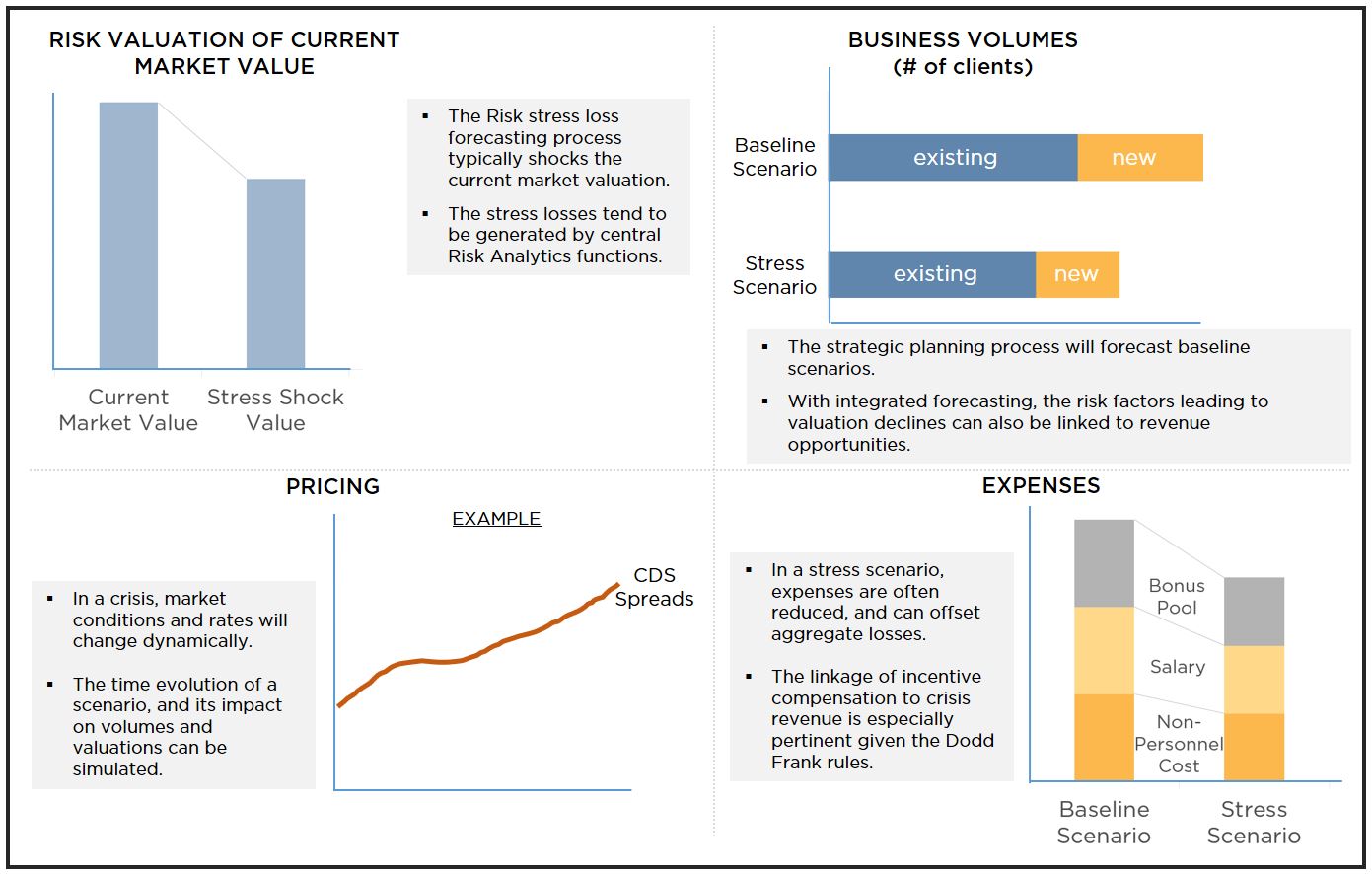

Risk Forecasting

We integrate risk stress loss forecasting from CCAR and similar regulatory testing into the strategic planning process. Our goal is to develop a process that yields opportunities and mitigates business risks while improving transparency through using risk based statistical techniques to better manage unforeseen scenarios.

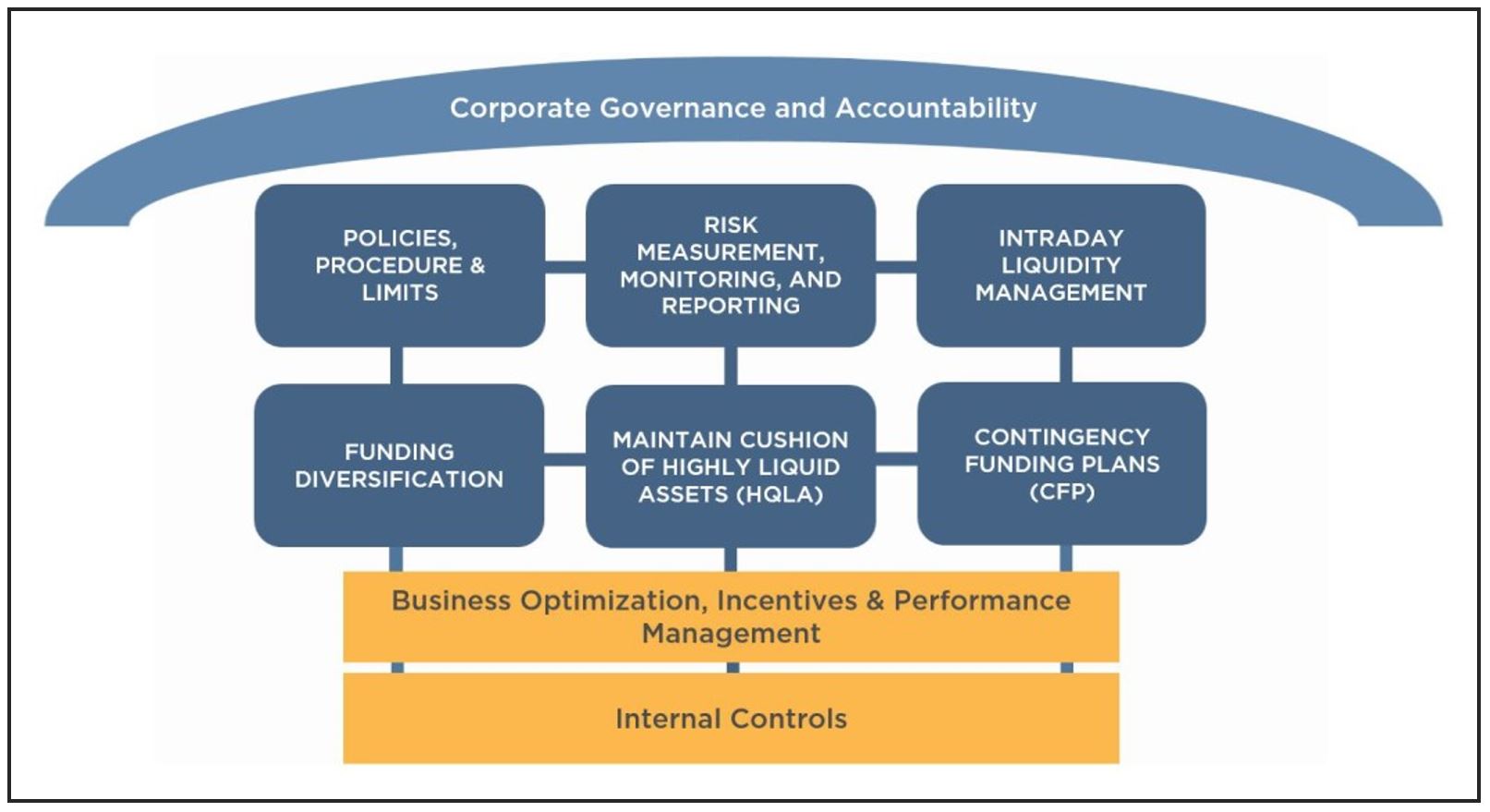

Liquidity Risk

We create intra-day liquidity risk management tools to cope with a dynamic market context. Our goal is to create a holistic and comprehensive framework that includes the measurement of trading activity and the impact on liquidity with relevant stress tests and limits.