Integrating Risk Forecasting into Strategic Planning (CCAR)

Integrating insights from risk stress loss forecasting and CCAR into the budgetary forecasting and strategic planning process.

Since the financial crisis, stress testing and Comprehensive Capital Analysis and Review (CCAR) has been central to the regulatory oversight process of banks and financial firms. The key goal of the stress tests has been to determine the adequacy of capital reserves, and the viability of capital plans including dividend and share buyback strategy.

We offer:

- Strategic Planning Process and Governance Design – Develop forecasting processes incorporating the comprehensive business context and leveraging leadership insights

- Reporting and Communication – Design of format and delivery mechanisms for communication to key constituencies

- Scenario Generation – Provide intellectual insights into the development of business-specific risk loss scenarios, with resultant financial context impact

- Validation – Review of existing strategic planning and CCAR processes to determine compliance suitability and optimization of business insight

- Rapid Response to Address Portfolio Gaps – Provide solutions for portfolios that are not included in standard tests due to systems build timing, data reconcilement or need for custom methodologies

Fully Integrated Business P&L Forecast Impact

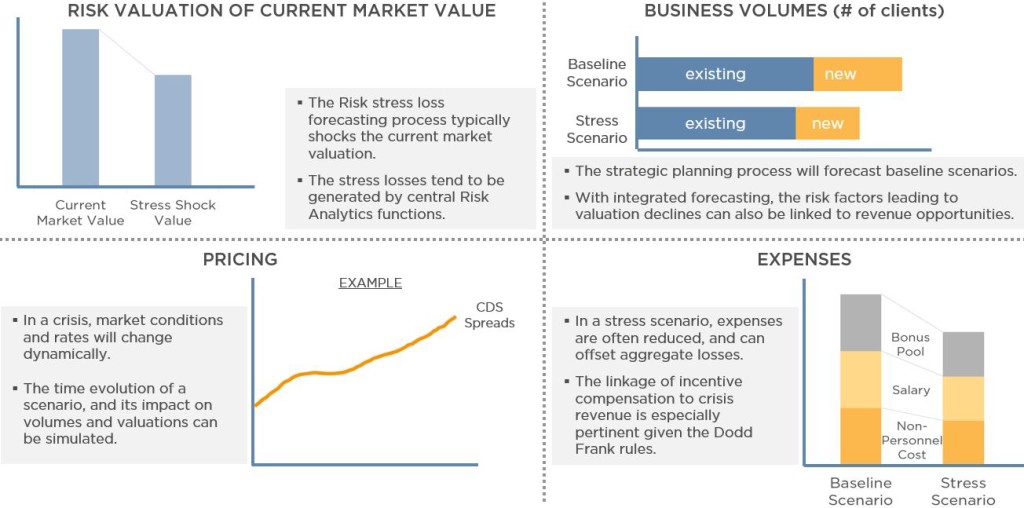

At most firms, the full value and insight from the data and scenarios supporting CCAR have yet to be optimally considered in the strategic planning process. In addition to simulating changes in valuations of the existing portfolio, progressive planning processes will also include considerations of changes in volumes, pricing, new business generation, and expense profit-and-loss (P&L) simulations. The integrated forecasting process envisions a paradigm where risk scenarios are co-determined and modeled by the line and risk management. The result is a scenario risk forecast for regulatory constituencies that is harmonious with the firm’s strategic planning and budgeting process.

Our Approach

We have expertise and talent in the risk management, financial forecasting and strategic planning processes. Through combining the data and methodological sophistication of the risk community, and the dynamic expertise of the business practitioners, we can help to bridge communities and insights. A consulting product is designed on a custom basis to suit the needs of a particular client, and can range from support towards building a strategic planning process, designing reports, or validating processes that have been implemented. The goal is to develop a process that yields significant business opportunities, improves the transparency and efficiency of planning communication internally and externally, fosters the innovative potential of both risk and strategy, and simultaneously decreases the risk of management being caught off guard by unforeseen risk scenarios.

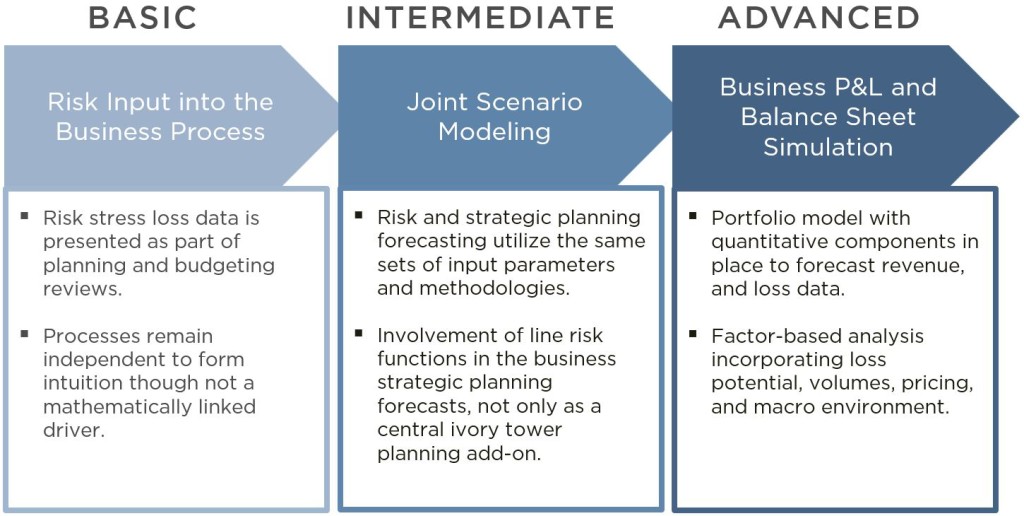

Different Levels of Integration of the Risk and Strategic Planning Process