Risk Enabled Investment Management

Crafting an investment process enabled by risk management that leverages technology, allowing investment managers to enhance risk-adjusted returns

We collaboratively work with investment firms to apply risk frameworks that utilize technology to optimize the investment decision-making process. We assist in developing methods across the different aspects of an investment process namely asset allocation, portfolio construction, and trade execution. The goal is to enable our clients to implement their investment ideas, while creating a process that produces the best possible consistent risk-adjusted returns.

We offer:

- Securities Modeling – Develop process and tools to analyze securities and decompose exposure into relevant risk factors

- Portfolio Construction – Design portfolio construction process to create risk-adjusted portfolios applying quantitative techniques and qualitative factors

- Investment Technology – Recommend technology solutions and architecture to support risk-based asset allocation, portfolio construction, and trade execution

Our Approach: Investing with Integrated Risk Management

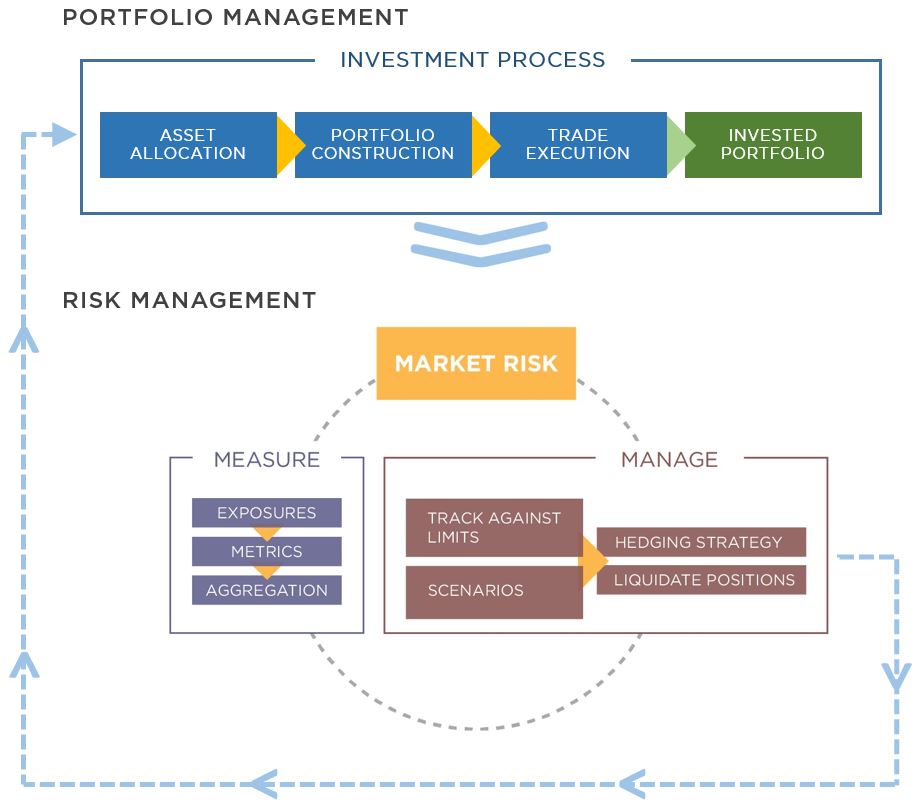

Investment managers have traditionally separated investment decision-making from risk management. Typically the risk management function is limited to tracking portfolio risk factors against pre-set limits, and then reporting the appropriate metrics to stakeholders after the fact. Adapting new technologies enables us to infuse risk management into the investment process during the trading day, enhancing portfolio performance and effectively creating a cohesive portfolio management and risk management process.

We use a framework that lets us analyze an investment process and determine how best to apply a risk management discipline to enhance risk-adjust returns. For example, this allows us to refine asset allocation to different asset classes, enhance the security selection and portfolio construction process, and improve trade execution across trading venues.

Developing an Investment Process

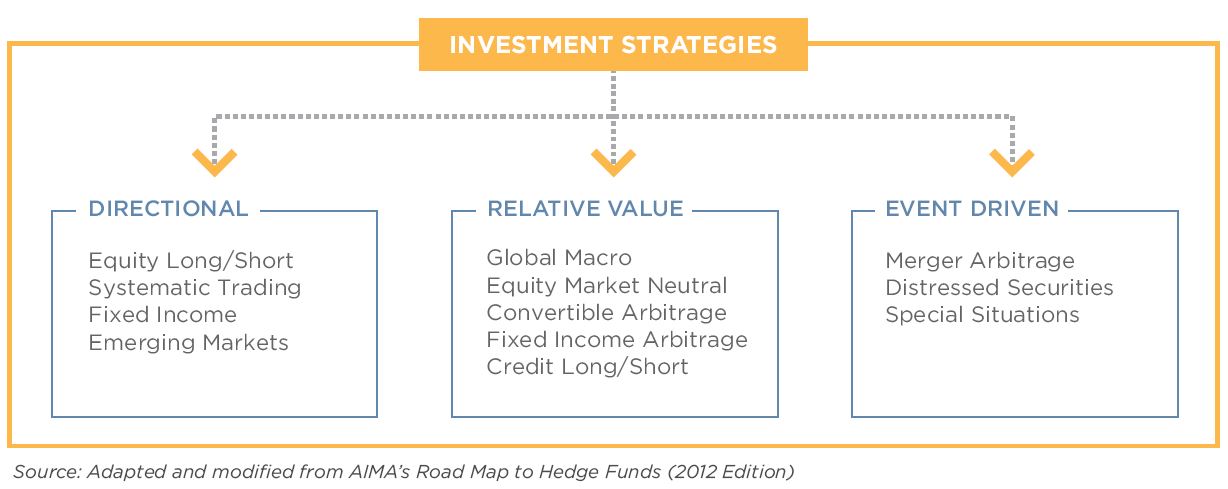

While investment strategies are varied and require varied experiences, analytical techniques, and information. Each investment strategy requires a thorough understanding of the investment thesis, the asset classes traded, and the associated risk factors.

However, the approach to develop an investment process for any given investment strategy can be thought of to use a simplified conceptual framework.

Applying Technology and Analytics

We believe that technology is a key part of the investment decision-making process and emerging technologies can have a significant impact on identifying investment ideas through processing disparate sources of information, aiding investment decision making through decision support tools, and controlling risk through more timely risk management.

Data Analytics

Applying data science allows us to increase the set of analyzable information that can be used for investment decision-making. Data analytics allows us to incorporate non-traditional unstructured data sources into investment processes to identify trends, anomalies, and track correlations.

RADiENT Investment Analytics Platform

We leverage RADiENT, our industry leading investment analytics platform, to integrate risk-based investment analytics, predictive valuation, and scenario analysis into the asset allocation and portfolio construction process.