Our Financial Analytics service provides analysis and tools to support banks, asset managers, private equity firms, and other financial institutions.

Financial Services & Data Science

We combine our financial services experience with data science expertise to enhance investment processes and financial decision-making, enabling sophisticated, data-driven insights for a wide variety of use cases.

![]()

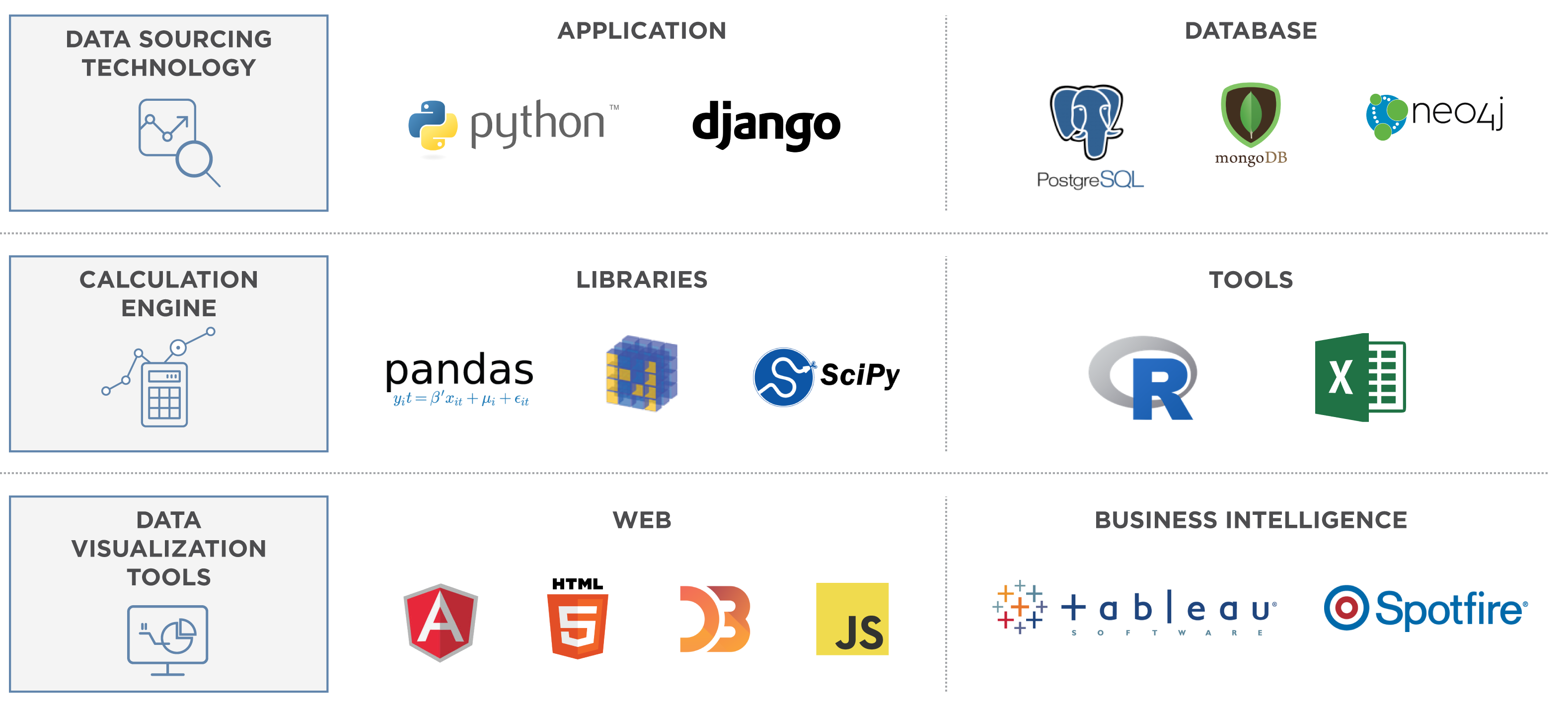

- Sophisticated data sourcing technologies seamlessly integrate data across multiple sources and formats

- Calculation engines compute risk measures and investment metrics

- Data visualization tools extract insights from data and generate new ideas, providing key analytics at-a-glance

Key Benefits

SPEED

Analyze Data and Test Hypothesis Quickly

Actionable analytics that become an integral part of the financial decision-making process enabling teams to analyze opportunities and isolate risks quickly.

INCORPORATE MORE SOURCES

INCORPORATE MORE SOURCES

Leverage Traditional Financial Data and New Sources of Unstructured Information

Include new criteria and metrics in financial decisions derived from sources such as news feeds, regulatory filings, and research reports.

VOLUME

Incorporate Large Volume of Data into Financial Models

Allow for the use of big data sets in financial analysis such as geolocation, website user tracking, and mortgage loan level data.

VISUALIZATION

VISUALIZATION

Visual and Interactive Analytic Tools to Uncover Trends Hidden in Disconnected Data

Empower analysts to understand and derive insights from disparate data sets using visual interactive tools, charts, and graphs.

DECISION MAKING

Decision Making Framework with Predictive Tools

Create data-driven systematic decision dashboards that leverage predictive analytical tools and utilize information from disparate sources and systems.

Our Tools and Platform

LIBRARY OF TOOLS

- Structure unstuctured sources-PDFs, Excel, web

- Natural language processing (NLP) to identify key themes in research documents, news feeds etc

- Sentiment analysis to identify and score views

- Interactive customizable dashboards

- Produce charts and infographics

- Integrate with analytic tools such as Tableau, Excel, MATLAB, R etc.

- Regression, correlation, variance, covariance models

- Time-series forecasting and trend estimation

- Principal component analysis and other statistical decomposition techniques

- Derivative and securities valuation

- Return-risk optimization frameworks that incorporate predictive market simulation

- Value-at-risk and market risk models with scenario analysis and stress testing

INVESTMENT ANALYTICS PLATFORM – RADiENT

- Market data time series tracking and forecasting

- Scenario analysis and stress testing

- Portfolio modeling and optimization

How It Works

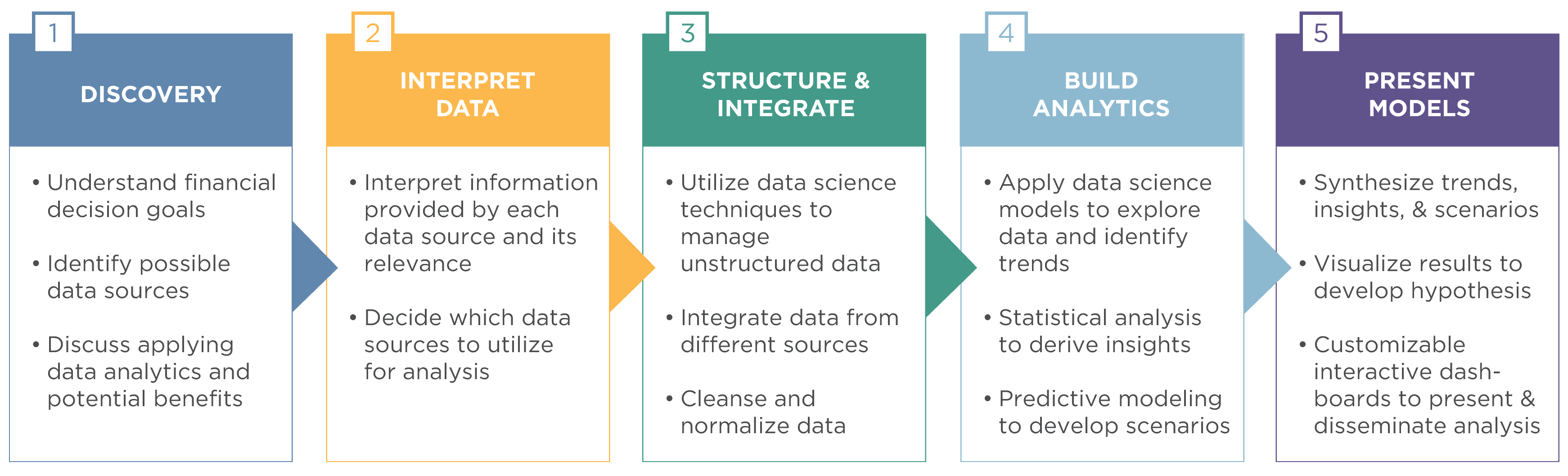

We work hand-in-hand with our clients, adopting a responsive, collaborative approach to custom tailor solutions to meet their specific needs. We provide rapid, high-impact turnarounds that support an iterative process with short lead times, adapting to changing priorities, data updates, or new sources of information as necessary.

Working With You

Our team of engagement managers and analysts collaborate closely with our clients to provide responsive, experienced service that meshes seamlessly with client needs. We are head-quartered in New York with our India Innovation Lab based in Mumbai, allowing us to service all major time zones.

Engagement Managers

Our New York-based team has deep industry experience working with global banks, asset managers, hedge funds, and private equity teams. We collaborate with clients to derive meaning and insight from data.

Analysts

Our experienced analysts combine their data science expertise with capital markets training, including relevant financial certifications (e.g. CFA, FRM, CPA, MBA).

Case Studies

CASE CLIENT

![]() Trade Market Impact Dashboard Multi-strategy HF $15B in AUM

Trade Market Impact Dashboard Multi-strategy HF $15B in AUM

![]() Insurance Settlement Valuation Multi-strategy HF $15B in AUM

Insurance Settlement Valuation Multi-strategy HF $15B in AUM

![]() Improving Market Risk Reporting Processes Large Global Bank $1.5T in Assets

Improving Market Risk Reporting Processes Large Global Bank $1.5T in Assets

![]() Portfolio Company: Luxury Fashion Brand Major PE firm $20B in AUM

Portfolio Company: Luxury Fashion Brand Major PE firm $20B in AUM

![]() Pricing Competitor Response Simulator Major PE firm $20B in AUM

Pricing Competitor Response Simulator Major PE firm $20B in AUM

![]() Customer Churn Analysis Global Payment Processing Solutions Provider

Customer Churn Analysis Global Payment Processing Solutions Provider

![]() Investment Research Applying Data Science Large Institutional Hedge Fund Investor

Investment Research Applying Data Science Large Institutional Hedge Fund Investor

Key Technologies