Trading Strategy Implementation – Backtesting and Data Acquisition

Developing a trading strategy requires meticulous backtesting and bringing together various sources of data

We collaboratively work with investment firms to implement trading strategies. We provide assistance with backtesting and data acquisition from traditional structured sources, and newer unstructured sources. We develop the tools and technology across the different aspects of deploying an investment strategy namely asset allocation, portfolio construction, and trade execution.

We utilize data science techniques such as artificial intelligence, machine learning, and natural language processing to acquire and analyze unstructured data from market research, news, regulatory filings and other sources. The goal is to enable our clients to developing trading strategies that take advantage of all available information and to implement these strategies efficiently and quickly.

We offer:

- Trading Model Backtesting – Assist in backtesting and tweaking trading algorithms and systematic models developed by your investments team.

- Data Acquisition – Acquire data for trading models from traditional structured market data vendors and automatically acquire and organize data from unstructured sources such as market research, news, regulatory filings.

- Alternative Data Sets – Structure data from various unstructured source to develop “alternative data sets” such as customer survey data, cell phone usage, and social media mining.

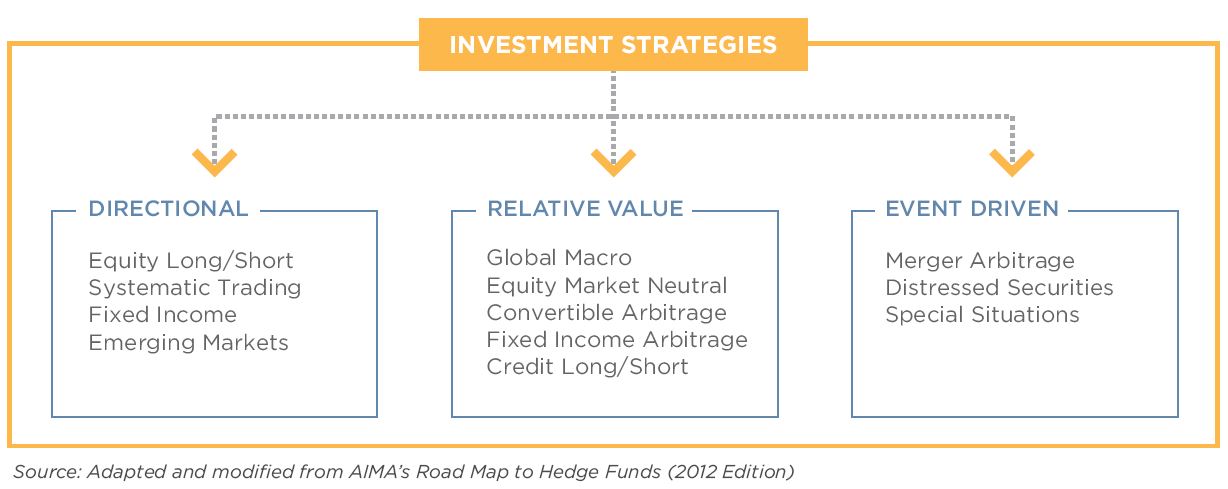

Developing an Investment Strategy

While investment strategies are varied and require varied experiences, they can benefit from a standard set of analytical techniques, and data technologies. We understand a broad range of investment theses, asset classes, and the associated risk factors. We assist with backtesting and acquiring all related data, allowing investment teams to focus on developing their investment strategies.

Applying Technology and Analytics

Data science techniques such as artificial intelligence, machine learning, and natural language processing can have a significant impact on identifying investment ideas through processing disparate sources of information, aiding investment decision making through decision support tools, and controlling risk through more timely risk management.

Data Analytics

Applying data science allows us to increase the set of analyzable information that can be used for investment decision-making. Data analytics allows us to incorporate non-traditional unstructured data sources into investment processes to identify trends, anomalies, and track correlations.

RADiENT Investment Analytics Platform

We leverage RADiENT, our industry leading investment analytics platform, to integrate risk-based investment analytics, predictive valuation, and scenario analysis into the asset allocation and portfolio construction process.