Liquidity Risk Measurement and Management

Creating a state-of-the-art liquidity risk management framework in a dynamic market context

Liquidity is the ability of a financial institution to fund increases in assets and meet obligations as they come due, without incurring unacceptable losses. The financial crisis exposed that many banks did not have an adequate liquidity risk management framework. Banks must appropriately measure liquidity risks posed by individual products and business lines, and incentives at the business level must be aligned with the overall risk tolerance of the bank.

We offer:

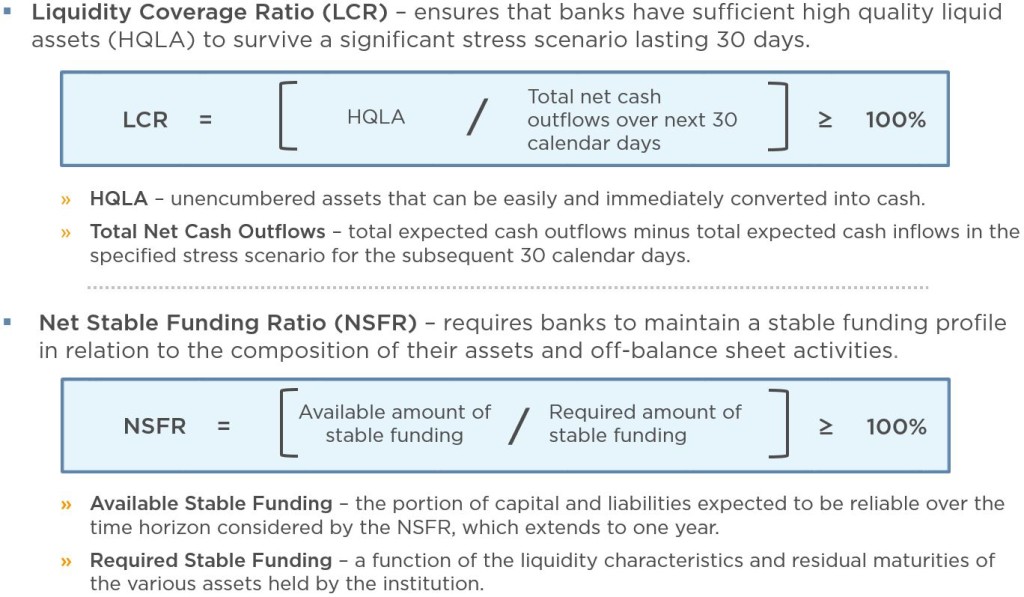

- Liquidity Risk Measurement – Review of existing strategic planning and LCR and NSFR processes to determine compliance suitability and optimization of business

- Corporate Governance Design – Develop comprehensive overview incorporating organizational design, liquidity guidelines, strategic business considerations, reporting requirements, legal entity, individual responsibilities, and policies

- Contingency Funding Plans – Design and plan contingent liquidity sources and processes under various adverse liquidity conditions

- Intraday Liquidity Management – Identify sources and uses of intraday liquidity, stress test scenarios, and implement monitoring tools

- Liquidity Gap Report – Implementation of liquidity gap report based on asset-liability sources-uses analysis for limit setting

- Liquidity Transfer Pricing – Harmonize credit risk with market and liquidity risk

Our Approach

We utilize a holistic and comprehensive framework that includes the measurement of business activities and design of stress scenarios to the strategic management of liquidity risk, creation of a corporate governance framework and validating processes that have been implemented.

Severe and prolonged liquidity disruptions are plausible, and stress tests that factor in the possibility of market wide strain or the severity or duration of disruptions should be conducted. The contingency funding plans (CFPs) of many firms should be linked to stress test results, but often fail to consider the potential closure of some funding sources. The allocation of costs to all significant business activities and the design and utilization of severe stress test scenarios will identify and measure the full range of liquidity risks. An integrated liquidity risk management framework and the development of a robust and operational CFP enables the strategic forecast and optimization of liquidity risk management.

The goal is to develop a process that yields significant business opportunities, improves the transparency and efficiency of planning communication, fosters the innovative potential of both risk and strategy, and simultaneously decreases the risk of being caught off guard by unforeseen risk scenarios.

Key Metrics of Liquidity Risk Management – LCR and NSFR