In the United States, under the Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), the SEC and CFTC requires registered advisers to hedge funds and other private funds to file Form PF (Form Private Funds). In addition, the CFTC requires hedge funds that are deemed Commodity Pool Operators to file Form CPO-PQR which has similar requirements but is nonetheless somewhat different. In the European Union, under the Alternative Investment Fund Manager Directive (EU AIFMD), hedge fund managers who market in the EU are required to report to the relevant regulator or National Competent Authority (NCA). Increasingly, regulators in other jurisdictions are implementing their own version of Form PF and EU AIFMD.

We offer:

- Collaborative Process – Coordinate internal project team from business groups and technology groups

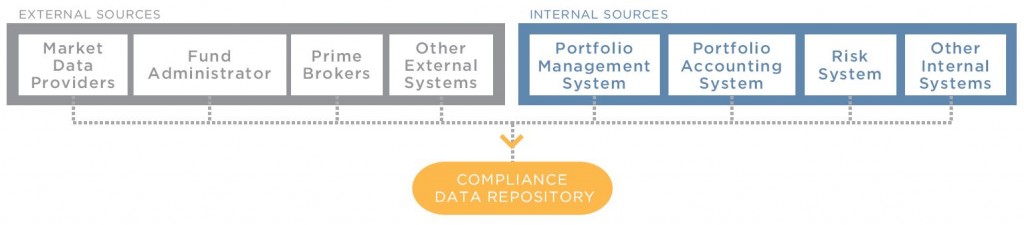

- Source Data – Identify and compile data sources for each regulatory report question

- Manage Vendors – Coordinate with system vendors and external data providers

- Analyze, Tag, and Aggregate Data – Create a compliance data repository for all required data

- Metrics – Calculate required measures and risk metrics

- Test Filings – Prepare sample test filings and coordinate final filings with the regulator

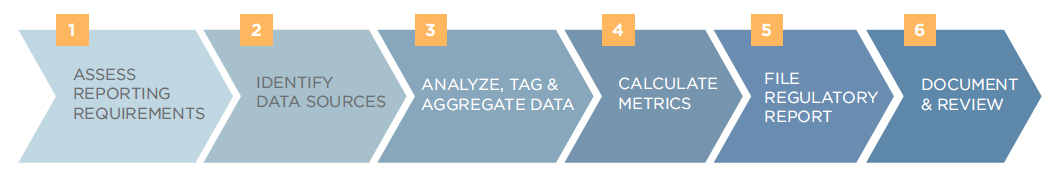

Our Process

While hedge funds have successfully completed their filings for several cycles, many have relied on an ad-hoc manual effort which is error prone, disruptive to regular business, and time-consuming for key personnel. We implement a structured workflow process to streamline regulatory reporting preparation and filing, reducing the time and effort required to file.

We enable our hedge fund clients to develop the operational capabilities to consistently manage their regulatory filings. We collaborate with our hedge fund clients to create both form preparation processes and technology systems, including identifying the different sources to collect the data from, classifying and mapping the data types into the required reporting categories, aggregating the data based on asset types as required by the regulator, and documenting the assumptions made as a guideline for future filings.

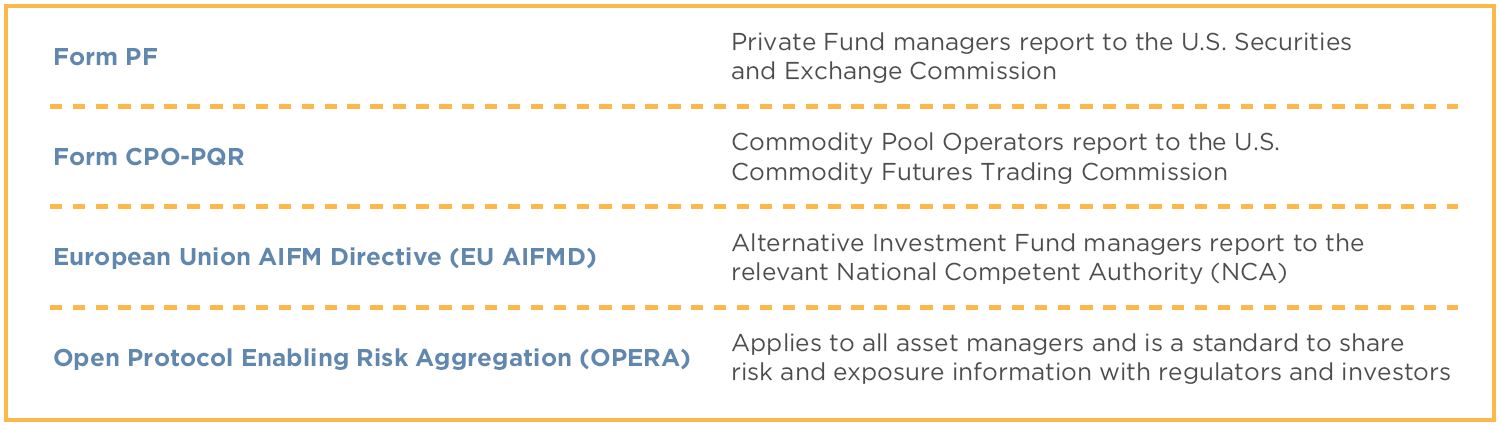

Supported Reporting