We assist professional Brazilian investors seeking to add international diversification to their portfolios. We share our research, expertise, and knowledge of the offshore international hedge fund market. We help identify international hedge funds that best address the investor’s diversification goals, performance targets, and risk parameters. Our engagement is tailored to the needs and objectives of the investor and includes: hedge fund manager selection, portfolio construction, periodic monitoring, and periodic rebalancing including allocation to new fund managers.

We offer:

- Manager Selection – Identify and select hedge fund managers through in-depth research

- Portfolio Construction – Develop a portfolio of funds using quantitative and qualitative asset allocation tools

- Exploratory Study – Introduction to niche strategies in the US, Europe, and key emerging markets

- Regulatory Environment – Explain regulatory changes and their impact on the hedge fund industry

- Information and Reporting – Regular reporting of qualitative information and quantitative metrics

- Investors from Brazil – Focused on understanding and serving the needs of investors from Brazil

Historical Context & Current Environment

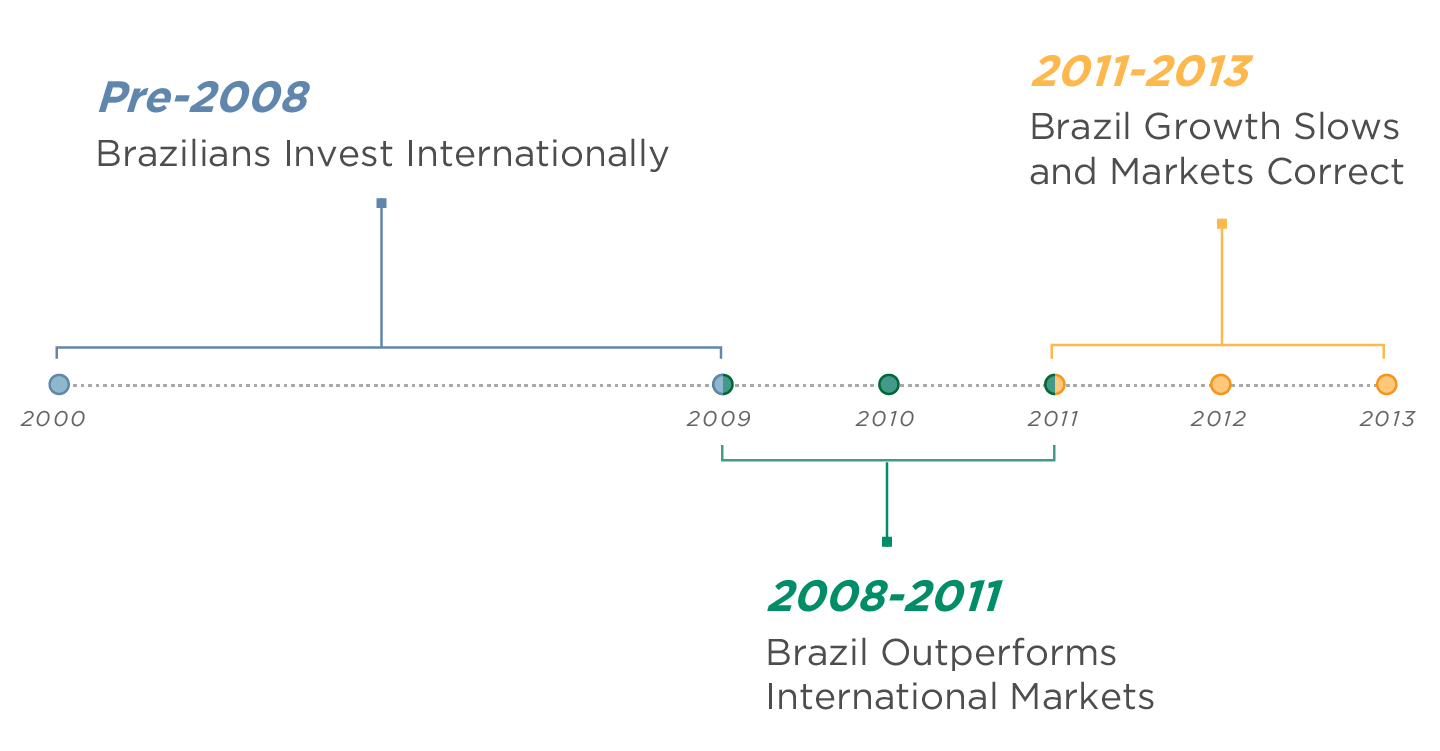

Pre-2008 Brazilians Invest Internationally

- Brazilians investors invested with international hedge funds with activity picking up considerably after 2000 as a result of the country’s growing prosperity

- Investors were largely High Net Worth individuals investing through private banks, single family offices, and multi-family offices

- Investors favored strategies commonly found at home such as Macro, Fixed Income, and to a lesser degree Long/Short Equity

2008-2011 Brazil Outperforms International Markets

- The financial crisis of 2008 caused a dramatic change in the international investing environment

- Brazilian investor sentiment towards offshore hedge funds turned negative fueled by poor performance, gating, and the Madoff scandal

- In contrast, the investment environment in Brazil remained robust, marked by solid economic performance, a booming equity market, high real interest rates, and an appreciating Real

2011-2013 Brazil Growth Slows and Markets Correct

- In 2011, the domestic economy began to slow and rising inflation resulted in deteriorating investment conditions

- The domestic equity market suffered a significant correction from which it has yet to recover

- Initially, high real interest rates kept investors focused on domestic fixed income options, but the deterioration of the Real in mid-2013 has dramatically altered their outlook

Currently, the condition of the local economy, the relative poor performance of Brazil’s equity market, and the deterioration in the value of the Real is causing Brazilian investors to re-enter the offshore hedge fund market. Domestic economic growth, especially in the financial services industry, has generated significant wealth and broadened the investor base. In addition, there are far fewer restrictions on offshore investing – greatly simplifying the task of diversifying their holdings internationally.

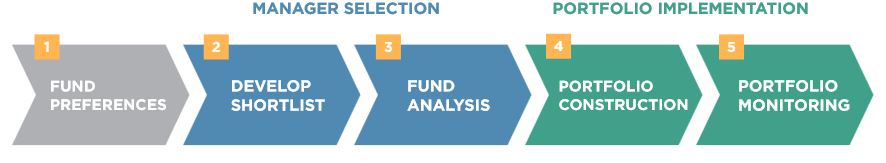

Our Approach

We engage with the Brazilian investor by providing services that are tailored to meet their objectives. We create a synergistic relationship between the investor and our investment process which supports either a single investment or the construction and on-going management of a portfolio of offshore hedge funds.

The Brazilian Offshore Investor Market by Segment

- Multi-Family Offices – the multi-family office market has grown significantly over the past five years, and has recently started to allocate significant capital offshore

- Single Family Offices – the inflow of international investments for the acquisition of local family-owned companies has been an impetus for the growth in the size and number of single family offices

- Private Banks – economic growth has created a mass affluent class that has been a major stimulus for the increase in private banking activity at domestic and international institutions

- Asset Managers – increasingly domestic asset managers are allocating to offshore managers to provide their investors international diversification

- Pension Funds – have traditionally invested domestically and that still remains their focus; however, regulations now allow for up to 10% of their assets to be invested overseas