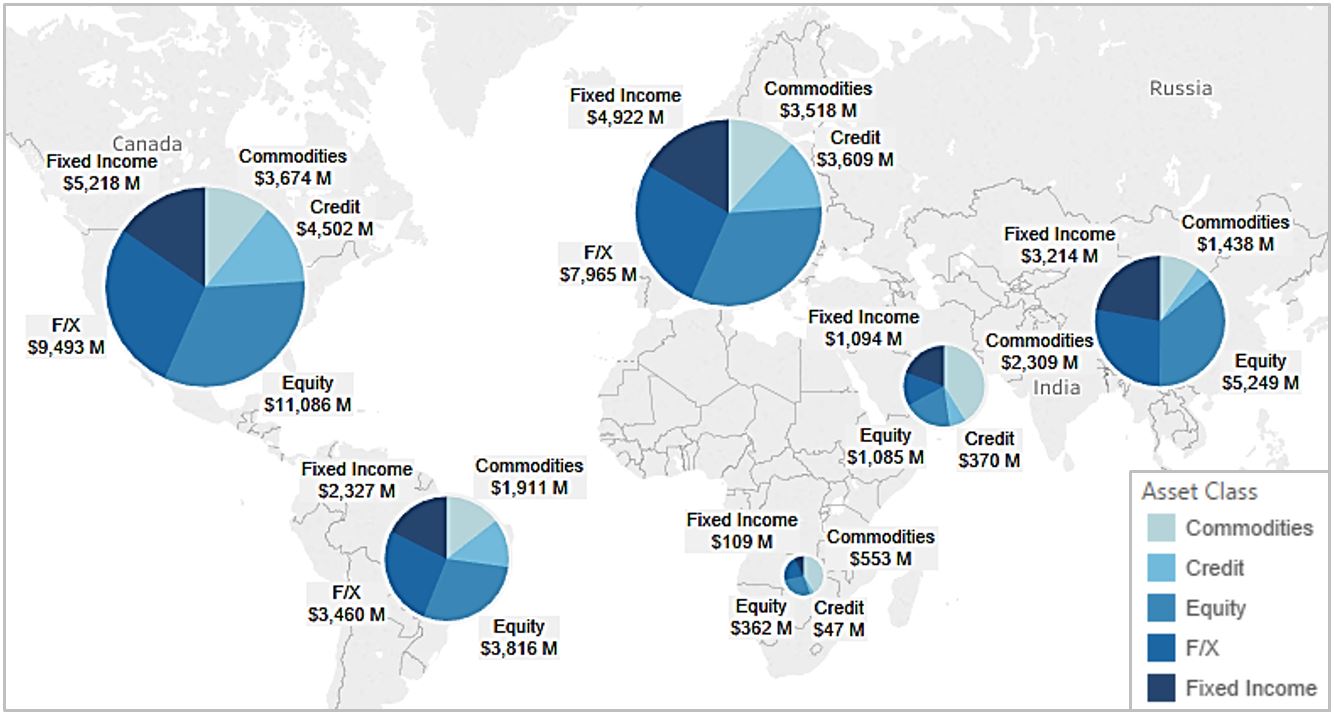

Value at Risk ($Millions)

Value at Risk ($Millions)

Case Study

A large global bank with $2.5 trillion in total assets and a leader in derivatives trading needed to improve its Market Risk reporting process which often took over-night to produce. The bank’s portfolios consisted of a diverse set of asset classes, requiring different exposure calculations. In addition, data was fragmented across portfolios and systems, contributing to the long processing times.

Solution:

- Apply data science such as Entity-Matching technique to extract and aggregate data from the different systems used across portfolios for the various asset classes to provide portfolio-level exposure details as well as bank-level exposure overview

- Implement automated asset class-specific data quality checks and calculation methodologies

- Created a dashboard applying visualization technique to enrich the readability of the risk reports

Benefit:

- Calculation time was reduced from over-night to same-day reporting, providing the Risk team more timely and accurate information on the bank’s risk exposures

- Data science allowed the aggregation and calculations on large datasets, resulting in consistent risk valuations across portfolios

- Transition from paper-based reporting to an on-line dashboard improved the accessibility and usability of the Market Risk reports for the Risk team

→ Related Service Offering: Financial Analytics as a Service