Market Impact Estimate

Market Impact Estimate

Case Study

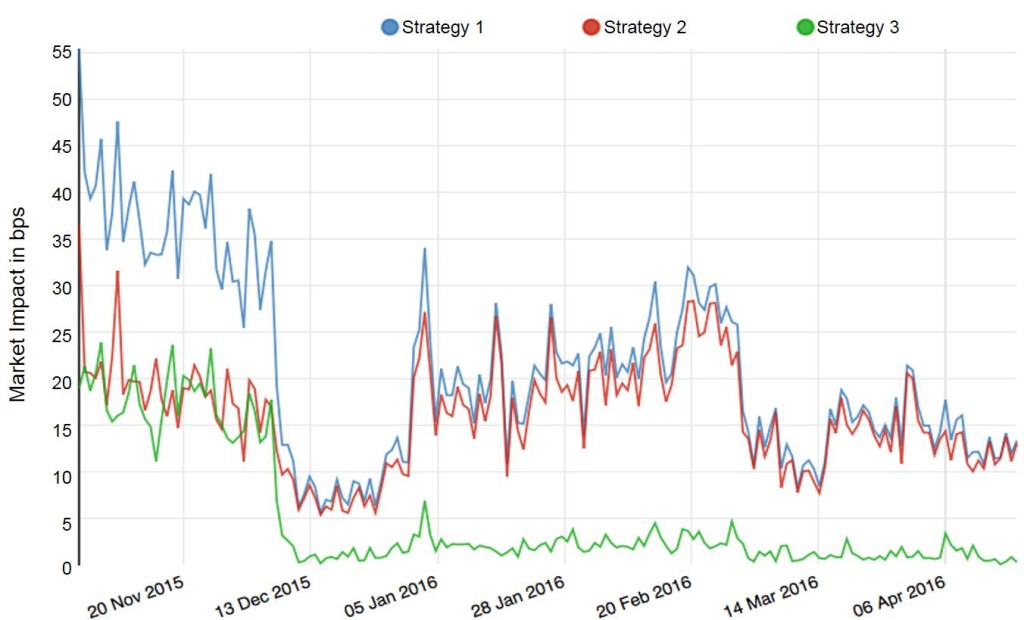

The management team at a multi-strategy hedge fund with $15B in AUM wanted to study the potential adverse market impact resulting from the trading activities of its algorithmic trading groups. Each team had a different trading system, which made the data collection and aggregation using traditional database methods challenging and time consuming.

Solution:

- Apply data science to integrate firm’s trading activities and market data stored in disparate systems

- Apply statistical analysis and industry best practices to study the price movement correlation due to trading activity by the algorithmic trading group utilizing the appropriate market impact model

- Develop a dashboard for management to view the market impact from historical trade data and perform pre-trade “what if” impact scenarios through predictive modeling

Benefit:

- Management team gained a robust process to track and derive insights on the market impact of each trading group through monitoring and analyzing their trading activities

→ Related Service Offering: Financial Analytics as a Service