Risk Advisors’ Jonathan Greenman as expert trainer at GFMI’s Marcus Evans event on Liquidity Risk Management

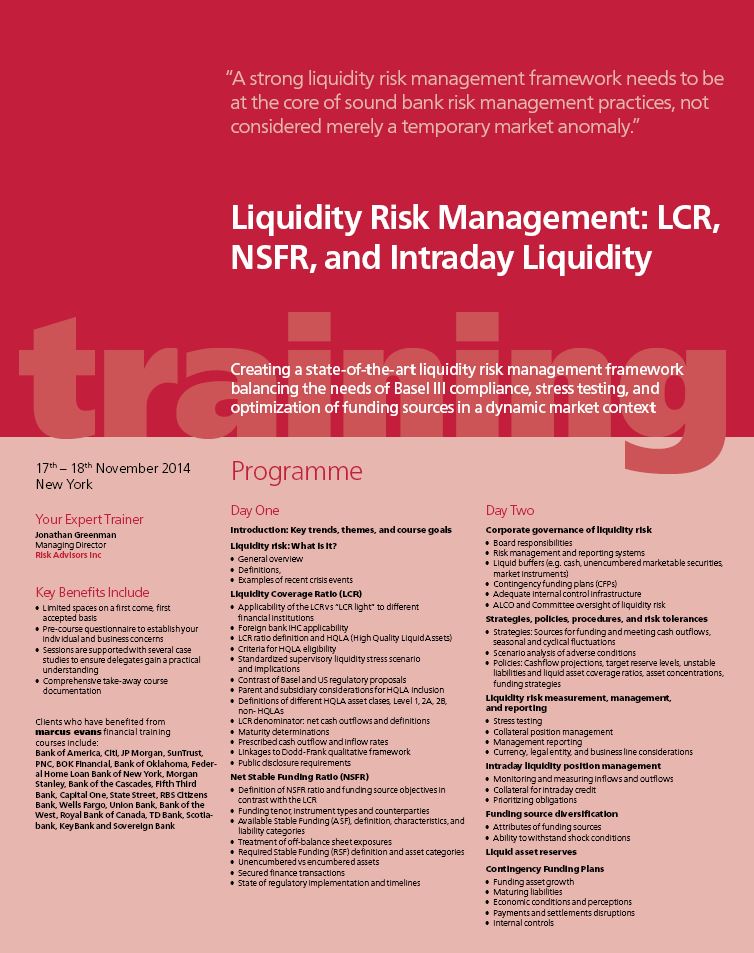

The Risk Advisors Inc. team is excited about the upcoming event Liquidity Risk Management: LCR, NSFR, and Intraday Liquidity – a training event on creating a state-of-the-art liquidity risk management framework balancing the needs of Basel III compliance, stress testing, and optimization of funding sources in a dynamic market context. The event is hosted by GFMI’s Marcus Evans and will be held in New York City on November 17-18, 2014.

Risk Advisors’ Jonathan Greenman has been invited as expert trainer for the event. He brings his experience in implementing future state architecture and infrastructure solutions for risk technology, and advising senior professionals on risk governance, to speak more on how “a strong liquidity risk management framework needs to be at the core of sound bank risk management practices, not considered merely a temporary market anomaly.”

Event Details:

November 17 – 18, 2014

9:00 AM to 5:00 PM (EDT)

Downtown Conference Center

157 William Street

New York, NY 10038

If you are interested in attending the event, register here.

About Marcus Evans

Marcus Evans specializes in the research and development of strategic events for senior business executives. From our international network of 63 offices, Marcus Evans produces over 1000 event days a year on strategic issues in corporate finance, telecommunications, technology, health, transportation, capital markets, human resources and business improvement.

Above all, Marcus Evans provides clients with business information and knowledge which enables them to sustain a valuable competitive advantage and makes a positive contribution to their success.

About Jonathan Greenman

Jonathan Greenman leads our Risk Strategies practice for Regulated Entities. He has extensive experience in risk management, business strategy, and financial planning. He has worked in several industry roles at Oliver Wyman, Citi, AIG, and Morgan Stanley focused on topics including Basel III, strategic planning, stress testing, economic capital, client profitability, risk rating models, loan loss reserves, and return on risk.