Best of RADiENT – 2017 Year in Review

2017 was a truly incredible year for product development at RADiENT. Our aim was to make fund management easier for our clients, and so we added numerous features geared towards that. As we move into the year ahead, lets take a look back at some of the highlights.

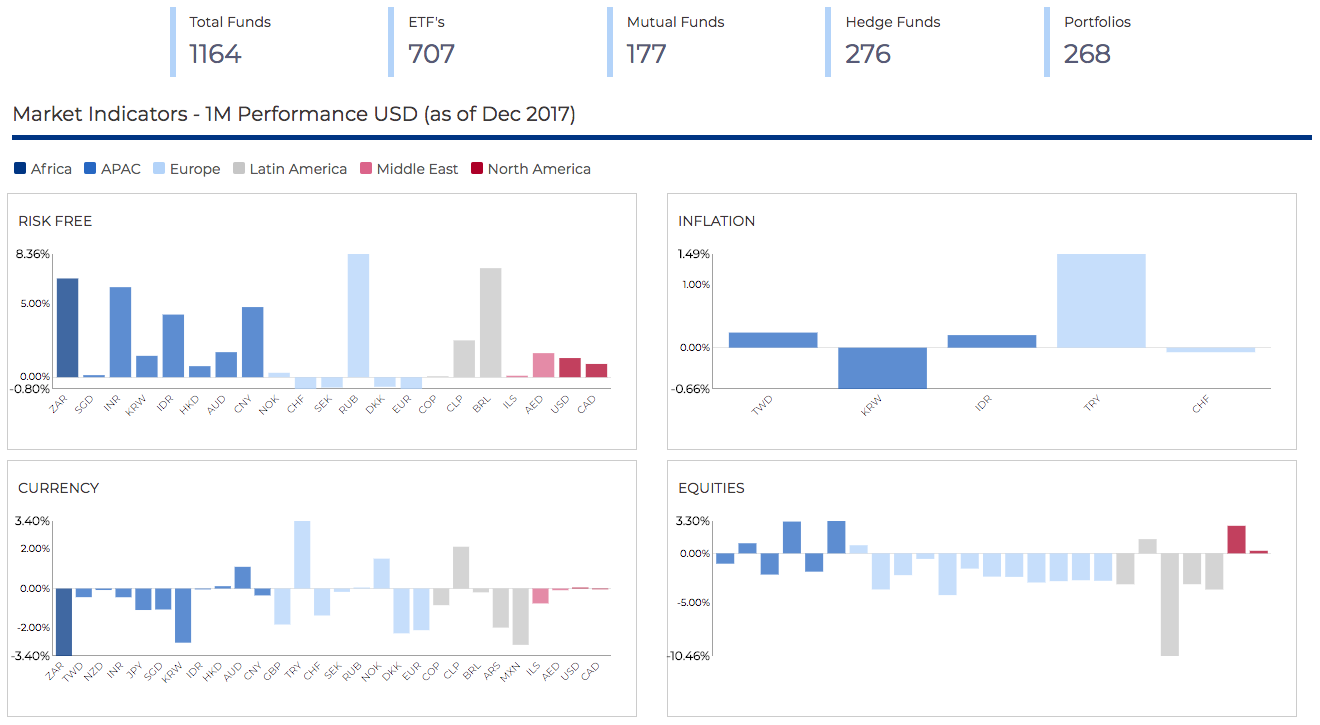

A New Dashboard

Review top performing funds and global market indicators right on your dashboard. For a more in-depth look, jump to any one of them with one click.

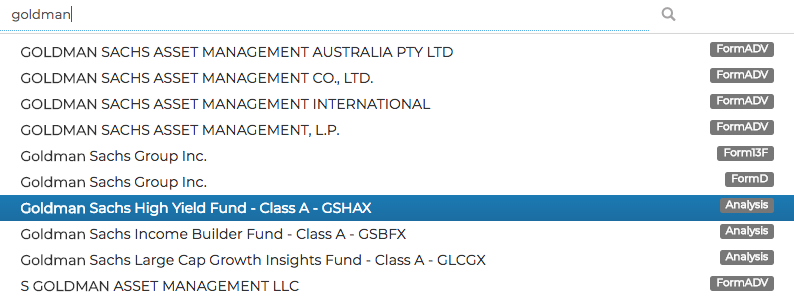

Easy Navigation

Our comprehensive new search lets you navigate to your choice of securities, benchmarks, regulatory filings, portfolios and more – all from the dashboard.

![]()

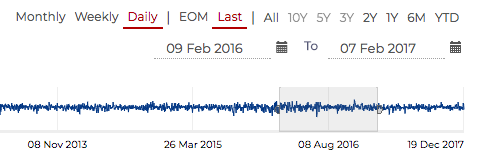

Daily Returns

Daily fund returns are now available, in addition to Weekly and Monthly granularity. Select one of the predefined time buckets or conveniently pick a custom range instead using the slider.

![]()

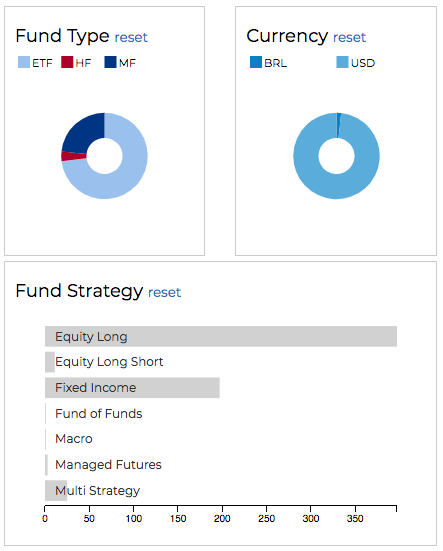

Simplified Fund Analysis

Visual tools and filters give you the flexibility to customize fund selection and portfolio construction.

![]()

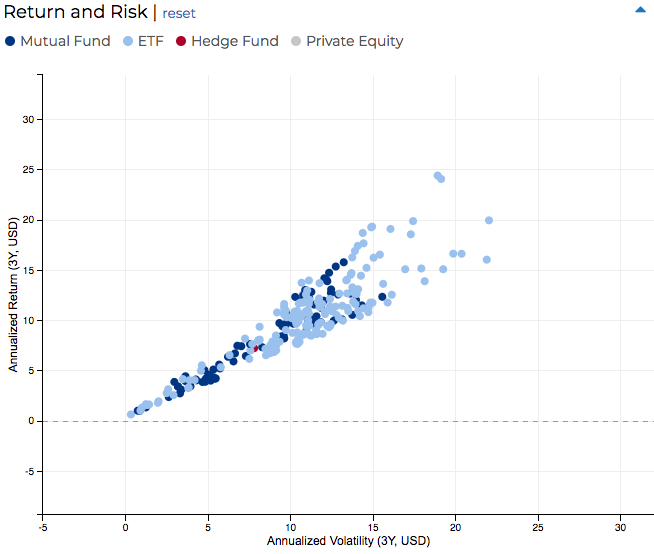

Peer Review

Group similar funds together and track their returns through Peer Groups. Set criteria based on Sharpe ratio, volatility, fund strategy or asset class

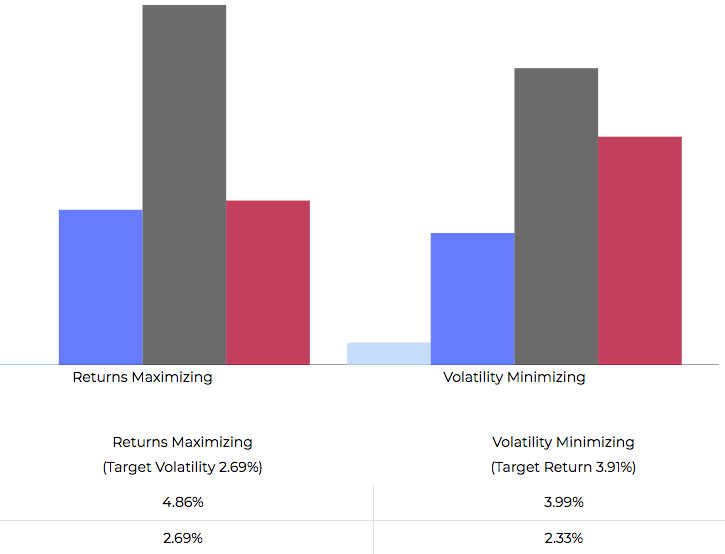

Portfolio Optimization

Mean-Variance and Scenario based optimization for portfolios.

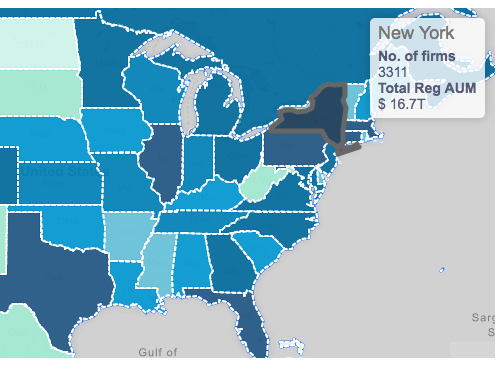

![]()

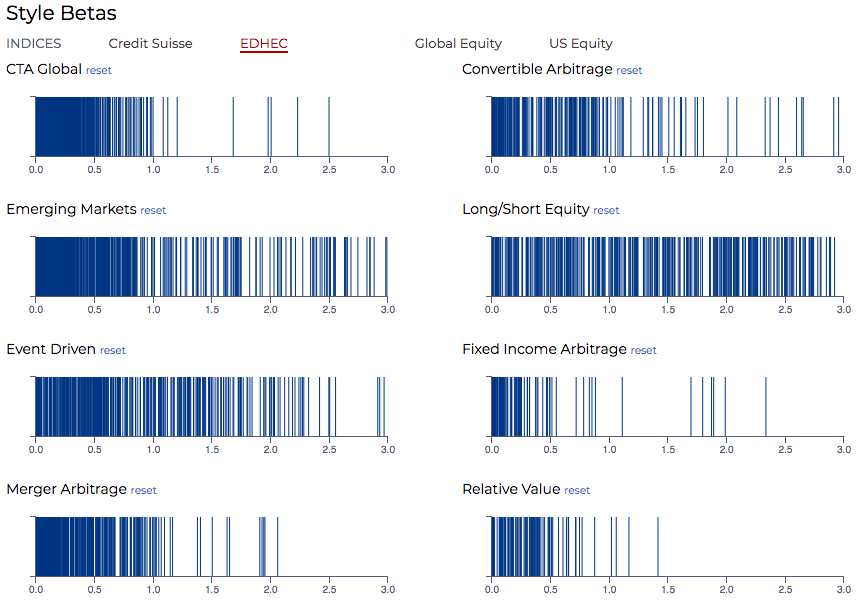

Global Data Coverage

We expanded our data coverage by adding more funds and indices to our database.

![]()

Form ADV Explorer

Data mined daily from SEC’s Form ADV filings for 18,000+ firms, including Section 7B & Schedules A-D. Advanced search for service providers & operational risk measure also available.

That’s a wrap for 2017!

Explore RADiENT Now

About the Author

Ada is a product manager for RADiENT Analytics working on conceptualising and developing new features. She also leads the UI and UX for the platform. She has previously worked with the Confederation of Indian Industry (CII) in New Delhi, India as a Research Consultant and with Liazon Corporation as a Systems Analyst in Buffalo, New York.

Ada holds a Masters in Quantitative Finance from University of Buffalo, SUNY and a Bachelors in Mathematics from the University of Delhi.