Alternative Investment Funds (AIFs) Take-Off in Style

Almost five years after SEBI introduced the Alternative Investment Fund (AIF) Regulations in 2012, statistics published by the regulatory body indicate that the AIF industry is well on its way to becoming a viable alternative to investment in Mutual Funds and Portfolio Management Services (PMS), for High Net-worth Individuals (HNIs) and Ultra High Net-worth Individuals (UHNIs).

An Alternative Investment Fund is a fund incorporated in India in the form of a Trust, Company or LLP. It is a privately pooled investment vehicle which collects funds from both Indian and foreign investors, and invests them in accordance with a defined investment policy. AIFs fall into 3 categories:

Category I funds invest in start-ups, early stage ventures, SMEs and other sectors which the government finds socially desirable.

Category III alternative funds are like hedge funds outside India; they use complex trading strategies and are permitted to use leverage (distinct from mutual funds and PMS services).

Category II funds are funds which do not fall in Category I or III, i.e. they do not undertake leverage or borrowing commitments. They are generally private equity funds and debt funds.

Growth of AIFs

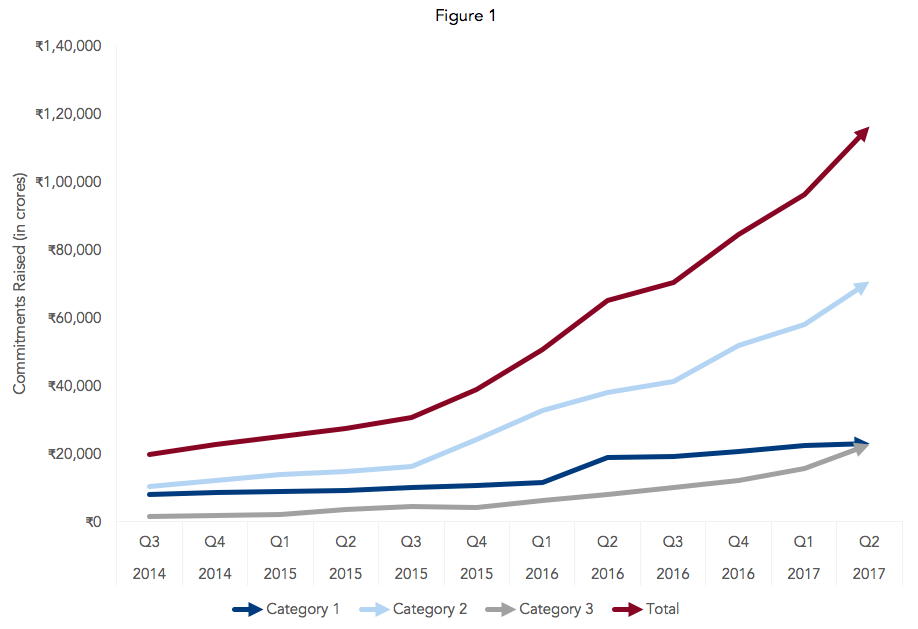

In Figure 1 above, we can see that the total commitments raised by AIFs since 2014 have increased from only ₹20,000 crores ($3.16 billion) in 2014 to over ₹115,000 crores ($18.15 billion) in September 2017. Out of this, more than ₹70,000 crores ($11.05 billion) are attributable to Category II AIFs i.e. PE and Debt Funds.

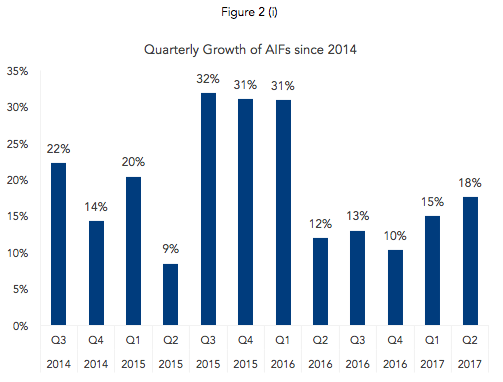

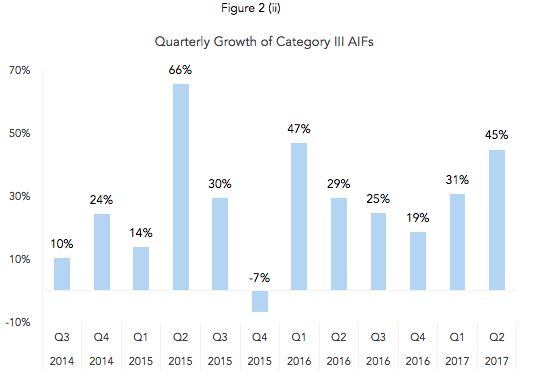

From Figure 2, it can be concluded that commitments raised by AIFs have consistently grown and have never dropped below 9% in any quarter since 2014. Out of this, Category III AIFs have an average commitment growth rate of around 28% every quarter. This can be attributed to the fact that prior to Category III AIFs being set up in India, leverage and complex trading strategy implementation was not possible.

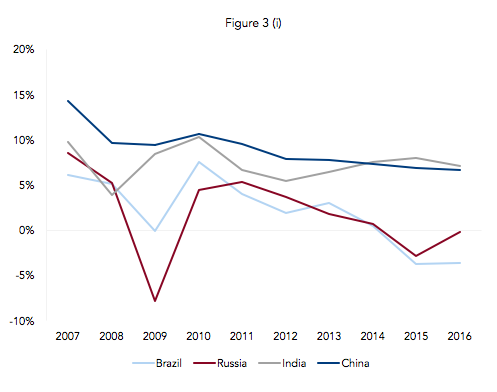

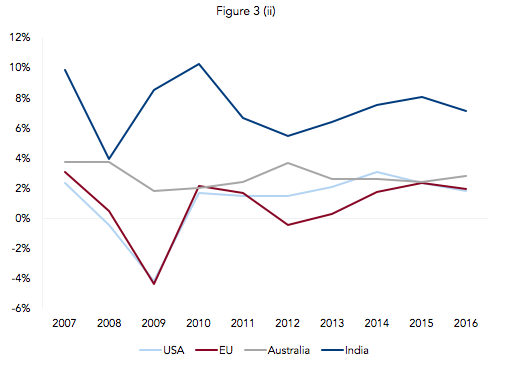

Another factor that has contributed to the growth of AIFs in India is the bull run of the Indian equity markets. Since 2014 the SENSEX has grown at a rate of 7.5% compounded annually. In addition, Indian GDP growth is pegged at an average growth rate of 7.35% from 2007 to 2016 while the world economy’s performance has not been at a similar level. This has induced Indian and foreign investors alike to invest in equity-related products.

The AIF industry’s potential for growth can also be stressed by the fact that its AUM(Assets Under Management) is still quite minimal compared to that of the Indian mutual fund industry, which stood at ₹20,93,145 crores ($307.81 billion) on September 2017. Further, the market capitalization of the Indian equity stock exchanges (National Stock Exchange and Bombay Stock Exchange) currently stands at ₹1,49,82,296 crores ($2203.27 billion) and ₹1,54,89,491 crores ($2277.86 billion) respectively.

Other Regulations for AIFs vis-a-vis Mutual Funds and Portfolio Management Services

Every AIF must have an AUM of at least ₹20 crores ($3.16 million). In addition, the Manager or Sponsor shall have a continuing interest in the AIF of not less than 2.5% of the AUM or ₹5 crore ($0.79 million), whichever is lower, in the form of investment in the AIF. The investment by an investor to the AIF must be a minimum of ₹1 crore ($0.15 million). Moreover, AIFs can raise funds from any investor whether Indian, foreign or non-resident Indians. Its close ended units can also be listed on a stock exchange.

Although, PMS services, on the other hand, necessitate a minimum investment amount of ₹0.25 crores ($0.04 million) per investor, they are not permitted the use of leverage and cannot pool investor money for any of their products. AIFs have a minimum tenure of 3 years, while PMS services have no such restrictions. Both AIFs and PMS services charge a management fee and performance fee for their services, like hedge funds in developed markets such as the United States.

AIFs triumph over mutual funds for HNIs and UHNIs because they can offer customized and higher-return solutions, which mutual funds cannot do due to their large volume of retail investors and sizeable AUM. AIFs also face fewer regulations.

Taxation

Category I and Category II AIFs have been awarded a pass-through status under the Income Tax Act. This means that while income is not taxed in the hands of the AIF, it is taxed when it is passed to the unit-holder, and the nature of the income is deemed to be the same as it was when the AIF earned the said income. However, income in the nature of Profits and Gains from Business and Profession is taxed at the fund level itself.

Category III AIFs do not have a pass-through status and consequently any income earned by these funds is taxed at the fund level, and is tax-free in the hands of the investors.

Transparency in India

Since AIF returns can be risky and volatile, SEBI has ensured that there are strong regulations in place for transparency and disclosure to the investors to the fund. Some of the measures taken are:

- financial, risk management, portfolio and transactional information regarding fund investments shall be disclosed periodically to the investors; and

- inquiries, legal actions pending, and material liabilities would also be disclosed.

SEBI has included a host of other regulations to ensure that all of the company’s activities are privy to the investors. This should encourage investments into these funds.

Funds Offered by AIFs in India

Some interesting funds launched by AIFs in India include:

- Emkay Emerging Stars Fund is an AIF launched by Emkay Investment Managers. The fund will invest in small and mid- cap companies having a market capitalization between ₹500 crores – ₹5,000 crores ($7.9 million – $79 million). The fund will be terminated, and money returned to the investors if it makes a gain of 300% at any time in the 5-year tenure.

- Absolute Return Fund is a Category III AIF by Avendus Capital. The fund will invest in Indian listed equities as well as equity derivatives, and will target to produce absolute returns with lower volatility than the overall stock market. The Fund will enter into long and short positions in equities, futures and options across a variety of market scenarios.

- Reliance AIF has launched funds in Real Estate, Fixed Yield and Equity offering post tax returns of 12.5%

Outlook

The AIF industry has been growing at a rapid pace ever since its regulations were introduced by SEBI in 2012. There are currently 366 AIFs registered with SEBI, while barely 92 AIFs were registered 2 years back. The AIF regulations are also relatively simple to interpret.

RBI and SEBI have also opened the AIF industry for Foreign Institutional Investors (FIIs) thus inducing further investments. Given that the Indian equity market still has a lot of open avenues for different investment styles, many managers are now shifting from traditional mutual funds houses to AIF divisions where the scope for experimentation is higher. AIFs are eligible to be classified as Qualified Institutional Buyers during Initial Public Offerings of companies and this would ensure that there is a high probability of allocation of shares.

With the rise in investment capital in India, the ongoing bullish equity market and increasing FPI and FDI investments, the outlook for the AIF sector is very positive. Though it is still too early to judge the returns from the funds already in the market, as of this moment the future of the AIF industry looks very promising.

About the Author

Sanjana is an Analyst in the India Innovation Lab at Risk Advisors Inc. in Mumbai. She focuses on client projects that require both an accounting background and statistical training, such as performance reporting and attribution.

Sanjana is an Analyst in the India Innovation Lab at Risk Advisors Inc. in Mumbai. She focuses on client projects that require both an accounting background and statistical training, such as performance reporting and attribution.

Previously, she was an Assistant Manager in the Treasury department at Anand Rathi NBFC, a securities brokerage and asset manager based in Mumbai. At Anand Rathi, she was responsible for option pricing, securities valuation, asset-liability modeling, developing risk management strategies, and financial markets analysis.

Sanjana is a Chartered Accountant (equivalent to a US CPA) and holds a Bachelors in Commerce from Symbiosis College in Pune.