Alternative Investment Funds (AIFs) in India

Last updated July 30, 2014

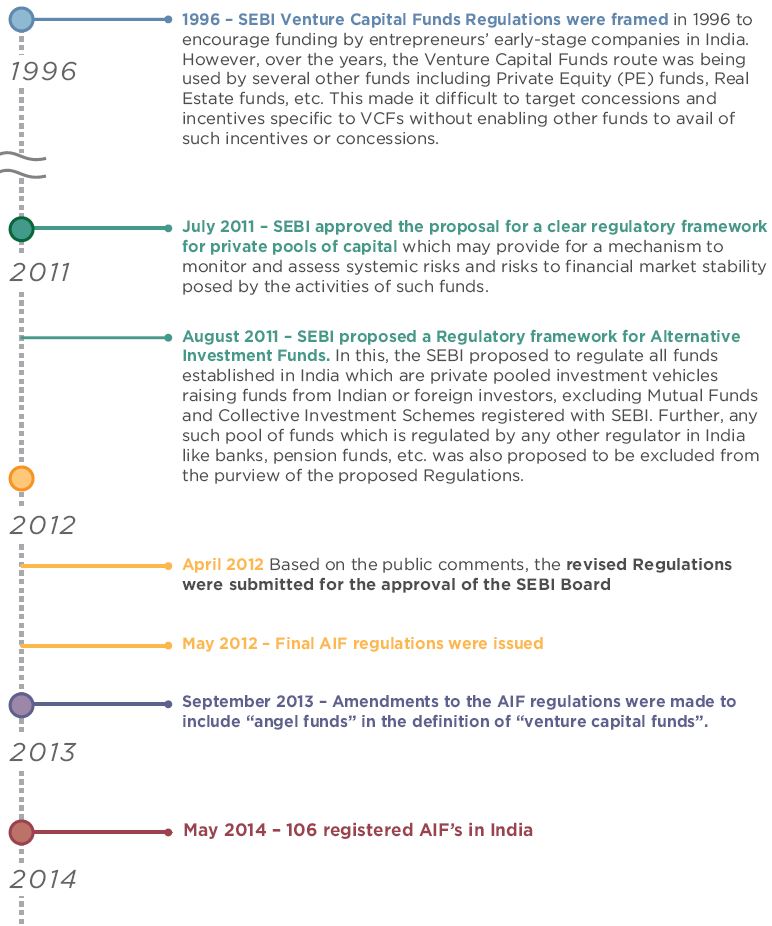

We have been tracking the evolution of Alternative Investment Funds (AIFs) in India since they were first proposed by Indian authorities in 2011. 2012 was a milestone year for the securities market in India as the Securities Exchange Board of India (SEBI) unveiled its final AIF regulations. It was just last year in September 2013 that Indian authorities clarified outstanding issues sufficiently which have finally led to several fund registrations and a handful of fund launches.

While hedge funds and private equity funds have operated in India for sometime under a confusing set of rules and regulations, these legacy fund structures are gradually being phased out. Under the old regime, hedge fund and private equity funds predominantly catered to foreign investors and excluded domestic investors, which hampered the growth of the alternatives industry. Now with a clearer regulatory framework and a new supportive government in New Delhi, we expect that it will grow significantly over the next few years. While there are still a few regulatory and tax-related questions outstanding, our colleagues in Mumbai are monitoring developments and are optimistic of the industry growing despite this uncertainty.

Timeline of AIF industry events

What is an AIF?

Alternative investment funds (AIF) in India are the equivalent of Private Funds in the United States and similar to AIF’s in the European Union. As per the Securities Exchange Board of India (SEBI) an AIF is a privately pooled investment vehicle that collects money from investors for investment in accordance with a defined investment policy. All investments are made for the benefit of the investors, who may be Indian or foreign. An AIF can be established in India either as a trust, company, limited liability partnership (“LLP”) or a body corporate.

AIF’s are not covered under the SEBI (Mutual Funds) Regulations, 1996, Securities and Exchange Board of India (Collective Investment Schemes) Regulations, 1999 or any other SEBI regulations to regulate fund management activities. 2012 was a milestone year for the securities market in India as the Securities Exchange Board of India (SEBI) unveiled its final AIF regulations. It was just last year in September 2013 that Indian authorities clarified outstanding issues sufficiently which have finally led to several fund registrations and a handful of fund launches.

AIF’s are divided into 3 categories:

1. Category I (eg: Venture Capital Funds)

AIFs with positive spillover effects on the economy, for which certain incentives or concessions might be considered by SEBI or Government of India; such funds generally invest in start-ups or early stage ventures or social ventures or SMEs or infrastructure or other sectors or areas which the government or regulators consider as socially or economically desirable. They cannot engage in any leverage except for meeting temporary funding requirements for not more than thirty days, on not more than four occasions in a year and not more than ten percent of the corpus.eg. Venture Capital Funds, SME Funds, Social Venture Funds and Infrastructure Funds.

2. Category II (eg: PE Funds)

AIFs for which no specific incentives or concessions are given. They do not undertake leverage or borrowing other than to meet the permitted day to day operational requirements, as is specified for Category I AIFs. eg. Private Equity or debt fund

3. Category III (eg: Hedge Funds)

Category III is primarily for hedge funds. These AIF’s can undertake leverage to a great extent, the leverage is capped at twice the AUM. These funds trade with a view to make short term returns. These funds are allowed to invest in Category I and II AIF’s. They receive no specific incentives or concessions from the government or any other regulator.

Regulation of AIF’s

Setting Up an AIF

An AIF can be established in the form of a company, a LLP or a trust, in accordance with the relevant Indian legislations governing these types of entities.

The most common structure to establish an AIF (which was also the structure adopted under the Venture Capital Fund Regulations) is as a trust, administered by a trustee company. The reason for the popularity of the trust structure is that it is the most tax efficient of all the available structures. An additional benefit of the trust structure is that the segregation of multiple schemes under the same registration (within the same category) is easier to manage.

Managers of AIFs are not required to separately register with the SEBI. However, managers of AIFs are required to meet the eligibility criteria under the AIF regulations. Additionally, managers are required to intimate the SEBI in case of any material change in the information regarding the manager which was submitted to the SEBI at the time of registration of an AIF. Any change of control in the manager would require the prior approval of the SEBI.

There is no separate registration requirement for advisers to AIFs. However, other than certain specific exceptions, all investment advisers providing investment advice are required to separately register with the SEBI.

Taxation

A Category I AIF can have one of two tax regimes:

1. Pass through Status: Category I AIFs which are Venture Capital Funds will have pass through status under the Income Tax Act, 1961. Income earned from investments by such AIFs in investee companies would be attributed to the investors directly and would be taxed in their hands. Venture Capital Funds would be tax transparent in nature and exempt from payment of tax subject to fulfilment of necessary conditions.

Incoming accruing or received by investors in Category I AIFs would be taxed in their hands directly in the same manner as if such investor had made an investment directly in the investee companies.

2. Trust taxation: In this case, a Category I AIF would have to be established as an irrevocable and determinate trust under the Indian Trusts Act, 1882. Investors would contribute money in the form of their investment and would be the beneficiaries of a contributory trust. Any income of an AIF organized as a trust will be subject to tax as per the general principles of taxation of trusts under the IT Act.

Category II AIFs and Category III AIFs, if established as irrevocable and determinate trusts in terms of the IT Act, would receive the same tax treatment as described above for Category I AIFs. No pass through status is available to AIFs registered under Category II AIFs and Category III AIFs.

Investor Requirements

An AIF may raise funds from any Indian as well as a foreign investor, subject to the extant regulations governing foreign direct investments. Each scheme of the AIF shall have corpus of at least USD 3.5 Mn and shall have a maximum of 1000 investor per scheme.

A minimum investment of approx. USD 175,000 from shall be required from each investor in the AIF. Where the investors are employees or directors of the AIF or of the fund manager, minimum investment of USD 43,000 shall be obtained.

The liability of the investors is limited to the amount committed by the investor to the AIF under the contribution agreements executed by each investor with the AIF.

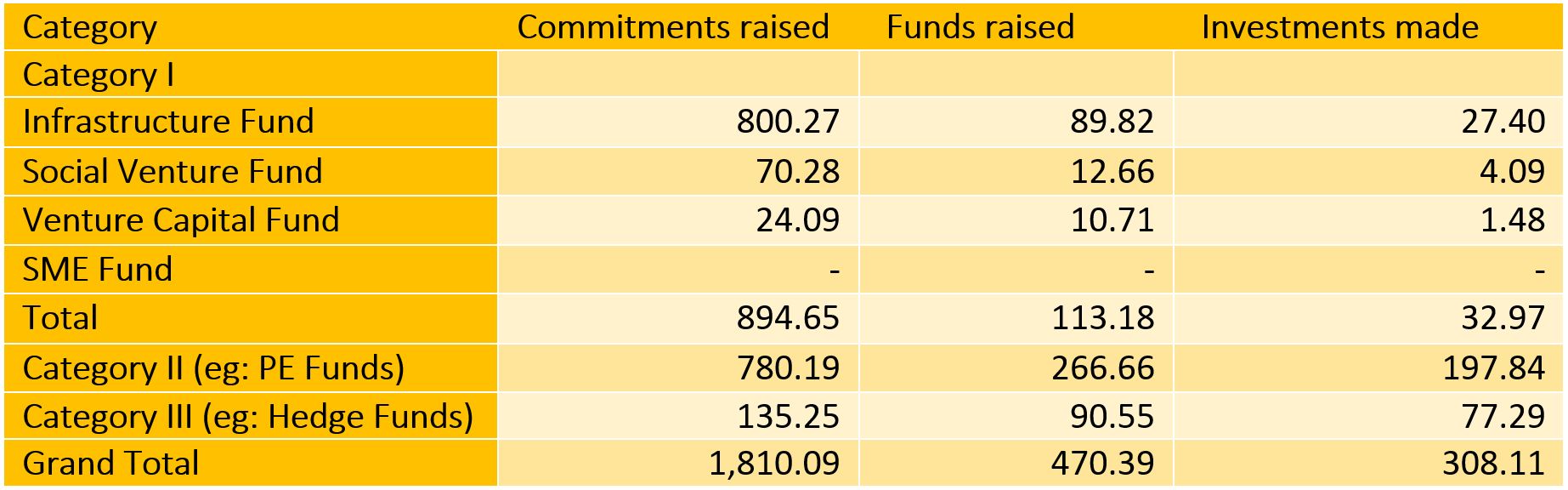

Data related to AIF’s in India

As of 25th May, 2014 here are some figures related to AIF capital raising and deployment (In USD MM)

As of 31st December, 2013 here are some figures related to AIF capital raising and deployment (In USD MM)

Asset Growth from 31st December, 2013 – 25th May, 2014

As of 31st May, 2014 there are 106 registered AIF’s in India