On-Demand analysis for private equity firms to rapidly evaluate investment opportunities pre-deal as well as make strategic operating decisions post-deal

At Risk Advisors Inc., we combine private equity industry experience with data science expertise to enhance investment decision-making & enable data-driven insights both pre and post deal across a wide variety of industries. Our product-based solutions backed by sophisticated analytical techniques and powerful visualizations will aid operating and management teams to take better informed decisions and add value to investments.

Know your customers

Analyze transaction data to identify key drivers that impact customer behavior.

Our CRM analytics techniques can aid due diligence efforts of PE firms and help increase bottom line performance of companies by personalizing customer communication and increase customer retention and profitability .

Stress Test your investments

Flexible pricing tools to model the impact of various assumptions with the help of simulation techniques.

Enable management teams to visualize the impact of pricing decisions on company’s bottom line, identify break even points and optimize target price suggestions to maximize revenue.

Stay updated with latest news

Extract information from unstructured data through advanced NLP techniques to create decision useful content in a concise and visually appealing format.

Enrich data on portfolio companies with social media feeds and add an analytical edge with sentiment analysis to evaluate your investment decisions.

Find the potential of acquired customers

Predict customer lifetime value and probability of survival during future time periods.

Aid due diligence and deal valuation efforts of PE firms by projecting revenue generated by customers.

Key Benefits

SPEED

Analyze Data and Test Hypothesis Quickly

Actionable analytics that become an integral part of the decision-making process enabling teams to analyze opportunities and isolate risks quickly.

INCORPORATE MORE SOURCES

INCORPORATE MORE SOURCES

Leverage Traditional Financial Data and New Sources of Unstructured Information

Include new criteria and metrics in investment decisions derived from sources such as internal company systems, news feeds, regulatory filings, and research reports.

VOLUME

Incorporate Large Volume of Data into Financial Models

Allow for the use of big data sets in financial analysis such as geolocation, website user tracking, and mortgage loan level data.

VISUALIZATION

VISUALIZATION

Visual and Interactive Analytic Tools to Uncover Trends Hidden in Disconnected Data

Empower analysts to understand and derive insights from disparate data sets using visual interactive tools, charts, and graphs.

DECISION MAKING

Decision Making Framework with Predictive Tools

Create data-driven systematic decision dashboards that leverage predictive analytical tools and utilize information from disparate sources and systems.

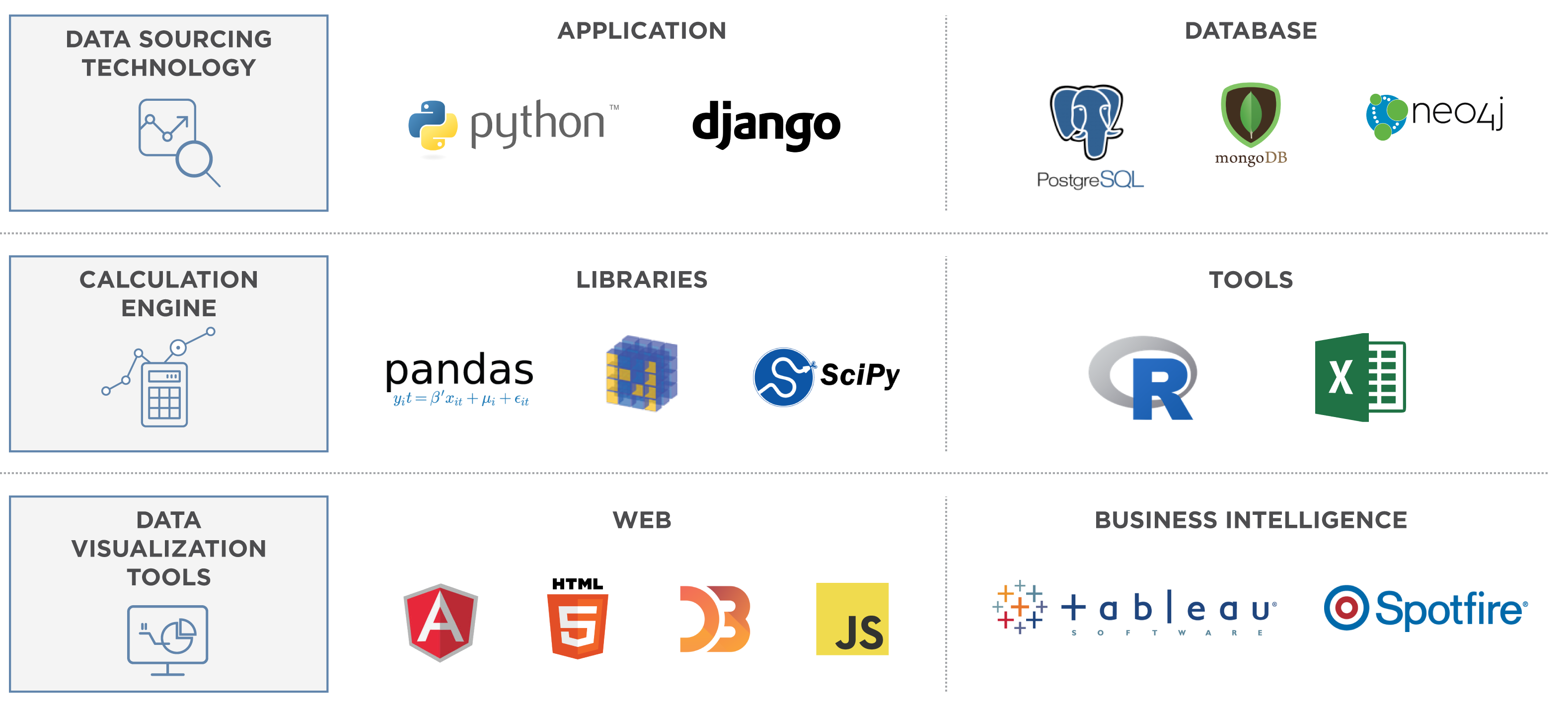

Key Technologies