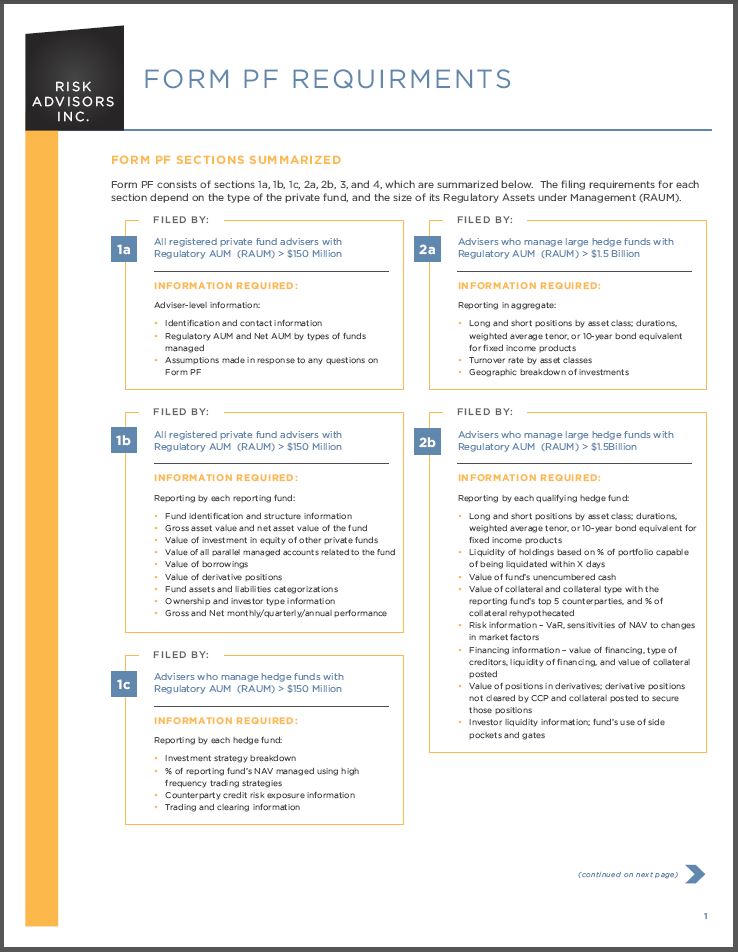

Form PF Sections Summarized

Form PF consists of sections 1a, 1b, 1c, 2a, 2b, 3, and 4, which are summarized below. The filing requirements for each section depend on the type of the private fund, and the size of its Regulatory Assets under Management (RAUM).

Information Required:

Adviser-level information –

•Identification and contact information

•Regulatory AUM and Net AUM by types of funds managed

•Assumptions made in response to any questions on Form PF

Information Required:

Reporting by each reporting fund –

• Fund identification and structure information

• Gross asset value and net asset value of the fund

• Value of investment in equity of other private funds

• Value of all parallel managed accounts related to the fund

• Value of borrowings

• Value of derivative positions

• Fund assets and liabilities categorizations

• Ownership and investor type information

• Gross and Net monthly/quarterly/annual performance

Information Required:

Required by each hedge fund –

• Investment strategy breakdown

• % of reporting fund’s NAV managed using high frequency trading strategies

• Counterparty credit risk exposure information

• Trading and clearing information

Information Required:

Reporting in appregate –

• Long and short positions by asset class; durations, weighted average tenor, or 10-year bond equivalent for fixed income products

• Turnover rate by asset classes

• Geographic breakdown of investments

Information Required:

Reporting by each qualifying hedge fund –

• Long and short positions by asset class; durations, weighted average tenor, or 10-year bond equivalent for fixed income products

• Liquidity of holdings based on % of portfolio capable of being liquidated within X days

• Value of fund’s unencumbered cash

• Value of collateral and collateral type with the reporting fund’s top 5 counterparties, and % of collateral rehypothecated

• Risk information – VaR, sensitivities of NAV to changes in market factors

• Financing information – value of financing, type of creditors, liquidity of financing, and value of collateral posted

• Value of positions in derivatives; derivative positions not cleared by CCP and collateral posted to secure those positions

• Investor liquidity information; fund’s use of side pockets and gates

Information Required:

Reporting by each liquidity fund –

• NAV, Weighted Average Maturity, Weighted Average Liquidity, gross yield, dollar amount of assets that have daily and weekly liquidity, maturity over 397 days

• Product exposures by maturity by asset types

• Financing information

• Investor information including investor liquidity

Information Required:

Reporting by individual private equity funds –

• Financing information – debt to equity ratios, maturity of debt financing

• Breakdown of investments in portfolio companies by industry

• Geographic breakdown of investments in portfolio companies by region and country

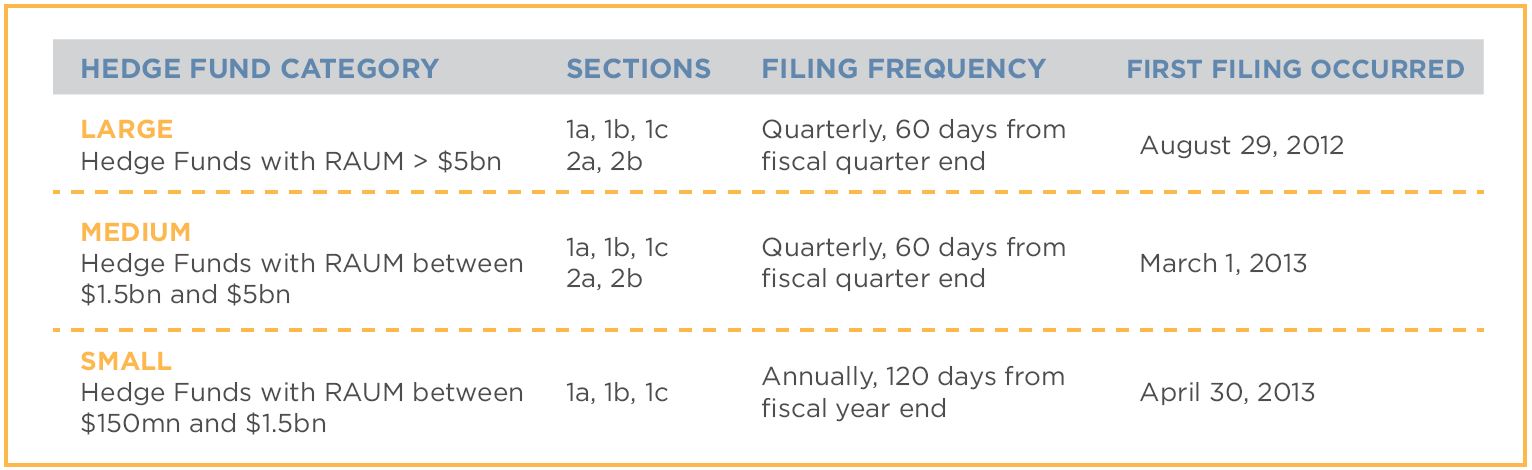

Which Hedge Funds Need to File?